Bank Stocks: Irrational Exuberance or Government Assurance as the Ultimate Risk Manager?

Partha Ray Download ArticleIn recent times the stock market has been performing rather spectacularly all over the world – so much so that the recently released World Economic Outlook of the IMF (released on January 22 2018) flagged “rich asset valuations” and the possibility of a “financial market correction” as a risk that could dampen growth and confidence.[1] India is no exception to this global trend. Each day we get pleasantly surprised to find BSE Sensex / NSE Nifty crossing another stratospheric mark. While the aggregate stock market story could perhaps be explained in terms of herd behaviour of the investors chasing of yield in consonance with a global trend, the purpose of this commentary is much narrower. This commentary looks into the recent trends in bank stocks and argues that the performance of bank stocks is out of sync with the performance of the banking sector.

Performance of Bank Stocks

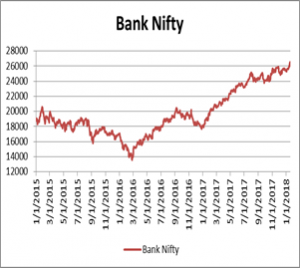

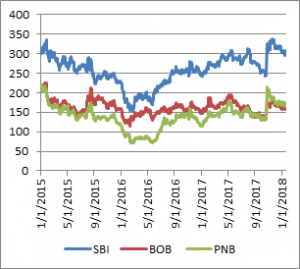

Chart 1 depicts the inter-temporal behaviour of banks stocks. Couple of stylized facts emerges from eyeballing the charts. First, Bank Nifty, the aggregate index representing bank stocks, is on a journey in the north-east direction nearly for the last one year. Second, in our selected sample of three public sector banks (viz., State Bank of India (SBI), Bank of Baroda (BOB) and Punjab National Bank (PNB)) stock prices of these three banks have also shown an increasing trend. Third, in our selected sample of three private sector banks, viz., ICICI Bank, Axis Bank and HDFC Bank, stock prices of these banks have also exhibited similar tendency; of course the extent of upward movement is shaper in case of HDFC banks.

But what is wrong with these increasing trends in the stock prices? Stock prices routinely go up or come down and it might be foolhardy to attempt to explain their behaviour. The only uncomfortable piece of information in these cases is that these upward trends in bank stock prices have been accompanied with a deteriorating performance of the commercial banks – particularly that of the public sector banks.

| Chart 1: Performance of Bank Stocks | |

|

|

|

|

| Source: Bloomberg. | |

Performance of the commercial banks

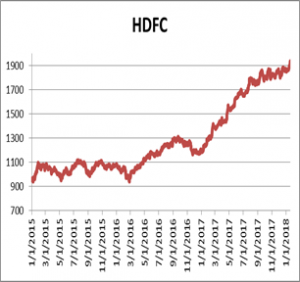

What has been the risk-return profile of commercial banks? Towards probing this question, I looked into RBI’s recent Financial Stability Report (FSR), December 2017 (released on December 22, 2017). The FSR categorically noted, “The overall risks to the banking sector remained elevated due to asset quality concerns”. Besides, it finds that the gross non-performing advances (GNPA) ratio and the stressed advances ratio of the banking sector increased between March 2017 and September 2017. Finally, the stress tests conducted by the RBI tended to suggest that in the baseline scenario, gross NPAs of the banking sector “may rise from 10.2 per cent of gross advances in September 2017 to 10.8 percent in March 2018 and further to 11.1 per cent by September 2018” (Chart 2). These warnings are indeed a case for concern particularly for the public sector banks.

| Chart 2: Asset Quality of Indian Banks

|

|

|

|

| Source: RBI, Financial Stability Report, December 2017. | |

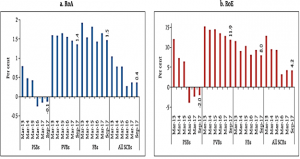

What has been the performance of the banking sector? Chart 3 plots two profitability indicators, viz., return on assets (RoA) and return on equity (RoE). Two important facts emerge from this chart. First, at the aggregate level, return on assets remained unaltered at 0.4 per cent between March 2017 and September 2017 while their return on equity declined from 4.3 per cent to 4.2 per cent during the same period. Second, for the public sector banks both the returns on asset and equity stood at a negative 0.1 per cent and 2.0 per cent, respectively as on September 2017.

Thus, as far as public sector banks are concerned, recent data reveals that their performance has been unsatisfactory and their risk profile has deteriorated in recent times.

| Chart 2: Profitability of the banking sector |

|

| Source: RBI, Financial Stability Report, December 2017 |

What is going to be the future risk return profile? We have already noted that the RBI’s Financial Stability Report has indicated that even under the baseline scenario, the gross NPA of all commercial banks are likely to deteriorate. But, under the severe stress scenario, seven banks have common equity tier (CET) 1 capital to risk-weighted assets ratio below the minimum regulatory required level of 5.5 per cent by September 2018. In sum, not only the present but the future of the public sector banks does not seem to be rosy. More specifically, the stressed condition of the commercial banks and their impressive performance in the stock market do not seem to add up.

Towards some conjectures

What would be possible explanations of this riddle? One obvious explanation is the presence of some irrational exuberance in bank stocks. But there are commentators who think otherwise. In fact, it has been pointed out that in explaining this impressive performance of bank stocks factors such as, shift in monetary policy or advances in technology, could have played a role.[2] Another explanation could be that the infusion of capital into the banks have assured the market players about the presence of the government almighty to rescue the public sector banks in the eventuality of any liquidity / bankruptcy problem or shortage of capital. Latest hue and cry about the Financial Resolution and Deposit Insurance Bill 2017 could have also convinced the market players about the infallibility of the banking system in India. The Union government announced the infusion of Rs. 88,000 crore of capital in ailing public sector banks on January 25, 2018. While it was a good to see that such capital infusion has been linked with a set of performance metrics, hope it does not encourage the syndrome of “privatization of profits and socialization of losses” in banking. Professor David Moss of Harvard Business School looked at government as the ultimate risk manager.[3] Metaphorically speaking, hope such an implicit role of the government as the ultimate risk manager would not fuel further the extent of irrational exuberance in bank stocks.

********

[1] http://www.imf.org/en/Publications/WEO/Issues/2018/01/11/world-economic-outlook-update-january-2018

[2] See for example, “4 reasons to ‘keep buying bank stocks”, Interview of Equity research analyst, Richard X. Bove to CNBC, available at https://www.cnbc.com/2018/01/23/banks-reach-a-state-of-nirvana-thanks-to-gop-bove-commentary.html

[3] David Moss (2002): When All Else Fails: Government as the Ultimate Risk Manager, Cambridge, Massachusetts: Harvard University Press.