The Fundamental Reason for drop in Bank Deposit Growth

Deep N Mukherjee Download ArticleFrom January 2016 onwards a fall in growth rate of deposits in Indian banking system has been observed. Some senior banking professionals claimed that this slowdown in growth of deposit has been among the reasons for limiting their ability to support high credit growth. Immediately economists jumped in with possible explanations for this slowdown in deposit growth. Most persons analyzing the event tended to conclude that the culprit was the public’s preference for holding higher amount of ‘cash’ i.e. notes/currency in circulation.

Some advocated a cut in CRR ratio, with the argument that from whatever deposit growth is happening if a lesser amount is kept aside as reserve, more ‘money’ will be available for lending. It appears very few of such policy advocates may appreciate the fact that banking system creates money, when it disburses loan. Practically (and as per the Modern Monetary Theory-MMT) the constraint to bank lending is not quantum of deposits but availability of capital to the bank.

Hunt for explanations: In fact a cursory look at the data, and their corrélations may prompt one to jump into the conclusion that increase in cash with public is causing the drop deposit growth. The ‘fundamental’ reason for the twin observations was ascribed to everything from election related spending, to public’s preference for holding cash since inflation has fallen, to avoidance of service-tax-payment by resorting to cash payment. Some discovered more interesting reasons such as public having prior knowledge of ‘demonetization’ and thus taking out deposit from bank to put aside in safe heaven assets such as gold!

Each explanation did its best to fit into the popular perception that deposit comes from currency-in-circulation and that gives bank the ability to extend credit. Some economists of course struggled to explain how, if real interest rate has improved (thanks to fall in systemic inflation, mostly the WPI), why was the savings growth rate falling?

Here some economists actually deflated the deposit growth, which is nominal, to calculate real deposit growth and suggest that the problem of deposit is not all that severe! Others argued that the relationship between real interest rate and savings is undergoing a change such that the increase in real interest rate is reducing the savings rate, because holding cash is becoming more attractive. So much for fitting the analysis results to provide an explanation that fits the dominant narrative- a classic case of confirmation bias.

Surprisingly, Credit is not identified as a reason: However, none of the reasons suggested that fall in credit growth is the reason for fall in deposit growth. As opposed to popular but incorrect understanding, which unfortunately is also seen in several macroeconomic text books, deposit growth does not lead to credit growth. It is actually the other way round. Credit comes first and then deposit (both demand (M1) and Time (M3) deposit) happens.

To the extent CRR is taken out of deposits, reduction in CRR is unlikely to boost bank’s ability to create credit ie; to lend. What a CRR cut does is to reduce the bank’s own need for cash. Thus bank’s overnight borrowing from each other and from the central bank is reduced. The improved liquidity condition, post CRR cut tends to bring down overnight interest rate. As per the ‘conventional’ thinking if one connects these dots (which are correct) and extends the argument that to the extent banks themselves would have to borrow less funds, at cheaper cost, for liquidity management, they conclude that the bank has more ‘money’ available for the purpose of lending. It is this conclusion which requires some rethinking. In this argument what is often missed is, as a banking system consisting of the central bank and all banking and lending institutions, the total money available has not changed in any meaningful way. So how is the banking system’s ability to lend increasing post a CRR cut? But more on banking system’s money creation ability later.

The Extent of Deposit Growth Problem

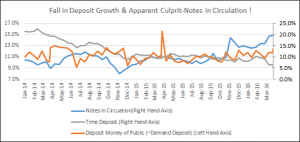

As of 31st March 2016, the growth rate in Demand Deposit (Component of M1) with bank was 11.8%(Y-O-Y). Though , the possible year end deposit collection drive , drove it to 13.7% in First week of April 2016. However, Time Deposit growth (Y-O-Y) for the same time frames were 9.5% and 9.1% respectively. As of 31st March 2016, the Notes in Circulation ie; Currency with Public grew by 14.9% (Y-O-Y). A year back, ie; 31st March 2015 the Y-O-Y growth of Demand Deposit, Time Deposit and Notes in Circulation was 10.7%, 9.8% and 11.3% respectively.

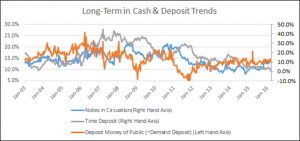

The 10-year average growth rate of Currency/Note in Circulation is ~14% and last 5 year average is ~ 12%. In that light the recent growth of Notes in circulation may also be seen as a reversion-to-mean, which moving back to long term growth of ~14%. It thus appears that the reasoning for crying wolf over increase in growth rate of currency/notes in circulation may be somewhat slim.

One can observe that post September 2015 there has been an uptick in growth of Notes in Circulation. However for the period April 2014 to September 2014, which is the period coinciding with the Lok Sabha election, the notes in circulation growth was around 10%. So the hypothesis that election causes notes in circulation is not supported by the data.

Volatile Nature of Demand Deposit Growth: Demand Deposits and Notes in Circulation typically constitute the M1 or narrow money. Bulk of demand deposit in India consists of current account deposits of businesses and to a smaller extent salary account. If businesses are undergoing liquidity stress, then demand deposit growth will suffer. If the corporates are over leveraged or bank’s risk appetite is low, both of which may be reflective of the current situation, and then growth in working capital credit is limited. This in turn will be reflected as poor demand deposit growth.

As the long-term trends show demand deposit growth rate are very volatile and almost mimics systemic liquidity positions as well as business performance. So between September-December 2008 demand deposit growth was negative as well as during FY2012.For next 18 months it averaged a moribund 6%. These were periods of FX stresses and business uncertainty.

The trend in growth rate of Notes in circulation and Time deposit have been showing a long term falling trend since January 2009. Time deposit typically consists fixed deposit with the bank. So far we have seen nothing to conclude that the public is making structural preference shifts of holding cash as opposed to putting them in deposit.

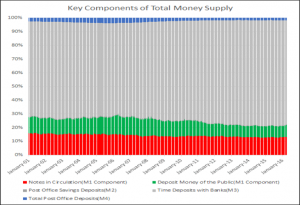

No Structural Shift in preference for cash: In the overall money supply, the contribution of Time Deposit has actually been growing, while demand deposit has been falling. The proportion of Notes in Circulation has been broadly stable, or at any rate it is not showing a structural uptick.

As such the growth of Broad Money Supply; ie M4 has been showing a falling trend since 2007-08 with brief spurts in 2011 and then again in early part of 2014. In part it is due to falling inflation which is causing a slowdown in Nominal GDP.

As of now one may hope that the sequential fall in growth of money supply (M4) since 2007-08 is not a sign of something more ominous, such as a structural moderation of growth in India’s economic activity.

Credit Creates Deposit, not the other way round

Joseph Schumpeter in his book ‘History of economic Analysis’ wrote “It proves extraordinarily difficult for economists to recognize that bank loan and bank investment create deposit.” The text book definition of bank is so ingrained and well accepted that it has taken the form of an unquestionable dogma. And that dogma goes something like this-banks accept deposits from public, for the purpose of lending, repayable on demand or otherwise. As per Adair Turner, erstwhile Chairman of Financial Services Authority, UK the above description of banking in modern economies is “dangerously fictitious”. That is because banks do not need deposits to extend credit.

The very process of disbursing credit creates money in the system, some of which remains in the banking system as deposit and some of it gets drawn out of bank deposit and circulate as cash in the hand of public. This is effectively endogenous money creation. Of course the entire money in an economy is not endogenously created. A portion of it is exogenous as well. Exogenous money is created when governments directly distributes subsidies or spends in the economy directly or when foreign savings get transferred into the economy.

To appreciate, what happens at operational level when a credit is disbursed is key to understand how banks create money in the process of lending. When a bank lends, it creates an asset, by debiting the borrower. Simultaneously the borrower’s deposit account is also credited with the disbursed amount. The borrower’s account can be either in the same bank or in a different bank. If it is in the same bank of course it will become a liability for the lender(remember double entry book keeping!). If the borrower’s account is in a different bank it will be a liability of that other bank. At any rate for the banking system as a whole a simultaneous credit creation as well as deposit creation occurs.

Now the borrower can write a check on that account and make payments, which will form deposit in the account of the receivers of that payment. Alternately the borrower can withdraw cash from cash counter of the bank or ATM and spend. In either scenario money gets created in an economy post credit disbursal. In one scenario it remains as deposit in another it adds to note/currency in circulation.

Specifically in India, since there is no long term shift in preference for cash it may be fair to assume that the deposit growth is falling because of slowdown in credit growth.

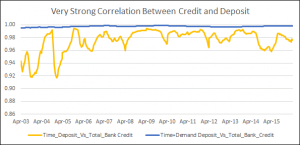

The relation between total credit and total deposit (demand plus time deposit) is functional or structural in nature and not stochastic. Thus when correlation is drawn on these two variables they are very close to 1.0 over a long period of time. So here is a case where a fundamental cause and effect relation may be validated by correlation. Of course the author acknowledges that correlation is a dangerous statistical tool and is more often abused than it is used.

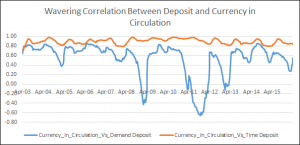

However, when one tries to correlate a relationship between Deposit and Currency in circulation the relation is more complex, definitely not straight forward and thus very high element of stochastics creeps in.

Given the wildly fluctuating correlation between Notes/Currency in circulation and deposits,analysts trying to explain the trajectory of deposit growth using notes/currency in circulation would sometimes have to resort to some interesting and unique explanations.

Conclusion

Indian banking system is currently struggling with NPA burden and huge credit losses. High amount of provision and write-offs is eroding profits for some banks while for others it is eroding their capital. As such it is not surprising that in general the banks may not have an appetite to lend. A combination of weakening risk appetite and in some cases constrained capital position, the supply of credit in Indian banking will remain muted for some time. The credit growth for next 18-24 months, is likely to be driven by retail lending. As such the overall credit growth is likely to be low since corporate credit accounts for bulk of the banking system loan book.

Corporates are either over leveraged or are struggling with over capacity issues and do not have investment requirement. The bespoke good corporates are unlikely to take credit now and the banks will not lend to over-leveraged corporates. To the extent bulk of the banks’ credit creation, creates money in the economy a chunk of which enters the bank deposit, poor credit growth will translate to poor deposit growth.

However the bigger and possibly more worrisome problem may be there. If a section of senior banking professionals or persons who may have an influence in policy making, do not have an appropriate understanding of bank’s money creation ability then they may cause sub-optimal decision making at policy or business levels. Ascribing inappropriate reason for the malady, will cause them to prescribe wrong medicine which will delay the patient’s recovery.

Reference:

a)Where Does Money Come From? : Ryan-Collins , Greenham, Werner , Jackson

b)Loans First-Explaining Money Creation by Banks :Arnab Kumar Chowdhury

c)Between Debt and The Devil: Adair Turner

d)History of Economic Analysis: Joseph Schumpeter

e)Modern Money Theory: L.Randall Wray