Macroeconomic Perspective of India’s Union Budget 2017-18

Sanjay K Singh Download ArticleThe Union Budget 2017-18 (UBFY18), in general, appears composed on its proposals except for some concerns related to banks’ recapitalization and passive private investment. The proposal positivity lies in its fiscal prudence (despite minor divergence of 0.2% up against mandated 3.0% under Fiscal Responsibility and Budget Management Act: FRBMA by 2017-18) and adherence to past commitments despite pressures generated from slower economic growth. Other attractive features of the UBFY18 are pursuance of digital economy, emphasis on infrastructure development, revival of rural economy (including affordable housing for the poor /underprivileged) and effort of simplification in the tax regime. The sharp rise in budgetary allocation on capital expenditure signals the government’s strong willingness to revive economic activity through public spending and generating crowd-in effect for private investment.

Given the structure and composition of rural economy in the overall Indian economy (due to its high demographic dependence albeit weakest contribution share), the budget proposal of doubling farmers’ income by 2022 seems to be catalyzing event for the rural economic activity. The government proposes agricultural credit of Rs 10 lakh crore for farmers and 60 days of interest waiver apart from strengthening of functional primary Agricultural Credit Societies network in next 3 years through NABARD at a cost of Rs 1900 crore. The UBFY18 stresses on further expansion of ‘Fasal Bima Yojana’ (up to coverage of 50% in FY19), more Krisi Vigyan Kendras (for coverage of soil sample testing with 100% coverage), irrigation network (including micro-irrigation) and national agricultural market (e-NAM: from existing 250 to 585 APMCs). The corpus for dairy processing and infrastructure development has been increased from Rs 2,000 crore to Rs 8,000 crore.

The government has proposed an annual allocation of Rs 3.0 lakh crore (grant-in-aid) for rural areas for providing basic infrastructure and employment through capital creation such as PMGSY roads, farm ponds and rural housing. The MGNREGA schemes also get all-time high allocation of Rs 48,000 crore in FY18 budgetary proposals. Another attraction of the UBFY18 is a proposal to construct 1 crore rural houses by 2019 (with budgetary allocation of Rs 23,000 crore). Target of 100% village electrification (by May 1, 2018) and skilling 5 lakh persons (by 2022) are other important budgetary proposals. The extension of safe drinking water network under National Rural Drinking Water Programme to 28,000 habitations in the next four years is another attractive rural welfare proposal. The government also proposes legislative reforms for existing labor laws on four codes of wages, industrial relations, social security and welfare and safety and working conditions. Any progress on these fronts could prove to be a positive support to the Indian rural economy in terms of better infrastructure and higher employability.

Despite high expectations from the budget, the government managed to keep budgetary proposals balanced except for marginal incentives in personal tax rates reduction, by slashing minimum tax rate from existing 10% to 5% for the lowest income bracket (up to Rs 5 Lakh) of tax payers. Although this proposal would generate downward pressure on personal tax collections due to its scale (under-reporting) linkages, any improvement in tax compliance in this income group under pursuance of digitalized economy after demonetization may neutralize the loss and has capacity to bring more positivity through multiplier effect.

An imposition of 10% additional surcharge on annual income higher than Rs 50 lakh to Rs 1 crore seems as a loss-mitigating move. The proposal of 5% reduction in corporate tax for MSMEs with turnover up to Rs 50 crore to 25% is a welcome step especially for manufacturing industry, (under ‘Make in India’ programme), given their dominance in the overall production profile. This proposal is an incentivizing step for MSMEs for greater entrepreneurial exploration on one hand, while a great positive proposition in creating of more jobs (for low skilled labor force) through cost reduction and diversifying product profile. The loss in corporate tax collections due to this reduction can be mitigated through better tax collection prospects on account of improvement in economic activity and employability.

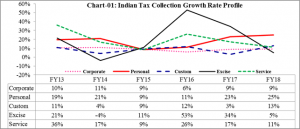

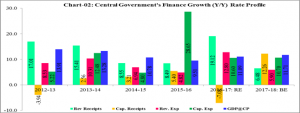

The analysis of government’s financial proposal, shows that government’s receipts would grow at 9.7% (a 4-year high) to Rs 21,21,046 crore in FY18, particularly on high growth of capital receipts (12.3%) along with high-base effect growth in revenue receipts (6.5%, a six-year lower growth projection) displaying incorporation of adverse impact of slower economic growth expectations. Although relatively slower growth expectation in excise duty (5.0% in FY18 against 34.5% in FY17) and service tax (11.1% against 17.1%) collection reflects impact of tax relief to MSMEs and service providers for digitalization acceptance, higher growth projection for personal income tax (24.9% against 22.8%) appears strongly based on assumption of broadening in tax base on scale.

However slower growth in budgeted expenditure (6.6%) seems to be realistic despite fiscal pressures generating from implementation of due installments of OROP scheme and ongoing social welfare expenditure, particularly on account of reduction in systemic leakages. The same can be observed from relatively slower growth in revenue expenditure (5.9%: BE in FY18 against 12.8% in FY17) than that of capital expenditure (10.7% against 10.6%) reflecting government’s seriousness in capital creation especially in infrastructure sector (railways, roads and ports). The sharp rise of 28.7% in the FY16’s capital expenditure (including grants for creation of capital assets) shows the government’s commitments of capital creation through various governmental channels.

As net market borrowing through government securities is projected marginally higher at Rs 3,48,226 crore (BE) in FY18 compared to Rs 3,47,219 crore (RE) in FY17, showing relatively better position of the government’s finance despite higher allocation on expenditure budget. Hence this budgetary proposal is expected to keep interest rate pressures under check, particularly due to stable domestic macroeconomic factors and limited exposure to external risks. Higher buyback/switching plan (Rs 1 Lakh crore) and Ways & Means inflows (Rs 3 Lakh crore) may create downward borrowing pressures through expectation channel and thus lower interest rate expectation. The same can be observed from relatively lower average 10-year benchmark G-Sec yield (7.00%) during April’16 – February’17 compared to 7.79% in FY16. Although excess systemic liquidity, lower domestic policy rate and a decline in SLR requirement (20.5% from 20.75%) would keep G-Sec yields range-bound in a narrow corridor in the next fiscal year; any quicker winding up process of excessive accommodative monetary policy in advanced economies may generate some short-term upward pressure.

| Table-01: Market Borrowing, Outstanding G-Sec, Liquidity (Re Crore) and Interest Rate Profile | |||||

| Market Loans | Outstanding

G-Sec Amount |

Average Daily | |||

| F-Year | Gross

Market Loan |

Net

Market Loan |

Net LAF Liquidity

(+ Variable LAF) |

10Y Benchmark

G-Sec Yield (%) |

|

| 2011-12 | 509796 | 436211 | 3808417 | -79947 | 8.370 |

| 2012-13 | 558000 | 467356 | 4456263 | -85084 | 8.156 |

| 2013-14 | 563675 | 468668 | 5116974 | -89167 | 8.397 |

| 2014-15 | 592000 | 453075 | 5799353 | -76707 | 8.305 |

| 2015-16 | 585000 | 440608 | 4566630 | -76092 | 7.786 |

| 2016-17: RE | 582000 | 406708 | 4943644* | 51424* | 7.006* |

| 2017-18: BE | 580000 | 423226 | – | – | – |

| Source: Union Budgets, RBI, CCIL & Researcher’s Work

(* April – February 2016) |

|||||

However, meager allocation (Rs 10,000 crore) for the PSU Bank’s recapitalization appears disappointing despite sharp rise in deposits after demonetization. However the 1 percentage point rise in provisioning for NPA gives some relief to banking industry due to its lower tax liability linkages, though lending constraints are still a big drag behind slower credit growth.

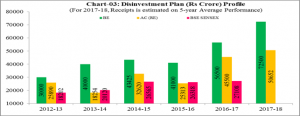

Despite robust macro-economic stability, the disinvestment target including strategic disinvestment appears overestimated given the preceding years’ performance averaging around 69.86% (5-year average) of the budget estimate. For FY18, the government proposed total disinvestment target (including strategic disinvestment) of Rs 72,500 crore, 28.3% higher than Rs 56,500 crore (BE) in FY17 and 59.3% higher than Rs 45,500 crore (RE) in FY17. However disinvestment decision would also depend on the performance of stock market for better pricing. Currently stock market is relatively better positioned, but lower real GDP growth expectations (6.75% – 7.5%) in FY18 and global uncertainty related to crude oil pricing, protectionist pressures on global trade and outward pressures on capital flows may keep Indian stock market range-bound.

The budgetary proposal of fiscal deficit profile looks good under all four major fiscal deficit indicators with falling trends, signaling government’s adherence to fiscal discipline despite sharp rise in capital expenditure and modest rise in revenue expenditure demonstrating government’s success in reducing systemic leakages in social welfare schemes through broadening of the direct benefit transfer net. The government should be given credit for its fiscal management approach particularly on front of slower growth in subsidy and reduction in systemic leakages.

| Table-02: India’s Deficit Profile (as % of GDP) | |||||

| F-Year | Primary Deficit | Revenue

Deficit |

Effective

Revenue Deficit |

Fiscal

Deficit |

Current

Account Deficit |

| 2011-12 | 2.70 | 4.40 | 2.90 | 5.70 | 4.20 |

| 2012-13 | 1.80 | 3.60 | 2.50 | 4.80 | 4.80 |

| 2013-14 | 1.10 | 3.10 | 2.00 | 4.40 | 1.70 |

| 2014-15 | 0.90 | 2.90 | 1.90 | 4.10 | 1.30 |

| 2015-16 | 0.70 | 2.50 | 1.60 | 3.90 | 1.20 |

| 2016-17: RE | 0.30 | 2.10 | 0.90 | 3.50 | 1.00 |

| 2017-18: BE | 0.10 | 1.90 | 0.70 | 3.20 | – |

| Source: Union Budgets & RBI | |||||

Intuitively prudent fiscal policy and sustainable debt path is the principal macro-economic anchor of the overall economy. In proposed budget, the government sticks to fiscal prudency albeit with a marginal rise (0.2%) in fiscal deficit / GDP ratio to 3.2% in FY18 against mandated 3.0% under the FRBMA. However, the government should be given credit for its fiscal discipline, provided intensified uncertainty in domestic economy (over demonetization impact, lower capital inflows expectation) and global economy (quicker hike in the US Fed Rate on account of rising inflationary pressure; uncertainty around commodity prices and protectionist pressures on global trade). These uncertainties with sluggish private sector investment and higher public expenditure may generate upward risk in fiscal discipline and consequently make fiscal deficit target little bit doubtful. The same can be observed from government’s escape clause under assumption of ‘far-reaching structural reforms in the economy for deviation of 0.5% from stipulated fiscal target for next three years – which can be interpreted as risk factor of unanticipated fiscal implications including macroeconomic conditions and political scenario in the coming years.

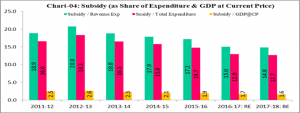

In the proposed budget, the overall subsidy is projected to grow 4.53% largely due to rising pressure from food subsidy – which is expected to grow at 7.52% despite good harvest and lower food prices. Although the government succeeded in keeping fertilizer subsidy with its budgetary target by making fertilizer ‘Neem-coated Urea’ and limiting its leakage to industrial production, the expectation of lower petroleum subsidy (-9.2% to Rs 25000 crore) is less likely due to rising crude oil prices and sensitivity to complete pass-through to end-consumers under political pressures. With growing coverage of National Food Security programme across different states, the food subsidy appears under-estimated and also depends on progress of monsoon next year. However any improvement in the direct benefit transfer on this account may keep the food subsidy target within achievable range.

| Table-03: India’s Subsidy Profile (Rs Crore) | ||||||

| F-Year | Food | Fertilizer | Petroleum | Interest | Misc. | Total |

| 2011-12 | 72823 | 67199 | 68481 | 5791 | 2002 | 216297 |

| 2012-13 | 85000 | 65974 | 96880 | 7968 | 2493 | 258315 |

| 2013-14 | 92000 | 67339 | 85378 | 8137 | 5148 | 258002 |

| 2014-15 | 117671 | 71076 | 60269 | 7632 | 5634 | 262282 |

| 2015-16 | 139419 | 72415 | 29999 | 16730 | 5542 | 264106 |

| 2016-17 : RE | 135173 | 70000 | 27532 | 19425 | 8356 | 260485 |

| 2017-18 : BE | 145339 | 70000 | 25000 | 23204 | 8733 | 272276 |

| Source: Union Budgets | ||||||

Other ratio measures of the subsidy profiling – Subsidy/Revenue Expenditure, Subsidy/Expenditure, Subsidy/GDP@CP (current price) show significant contraction in the overall subsidy in last five years, showing decline in systemic leakage in fertilizer subsidy and food subsidy and complete pass-through of petrol/diesel prices to consumers apart from holding benefits of lower crude oil prices in the current fiscal year. Despite further expansion in providing subsidized LPG (cooking gas) connection to poor households, the trend decline signals better subsidy management.

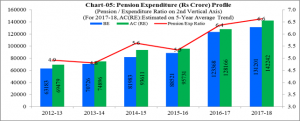

Another pressure on central government’s fiscal position arises from sharp rise in pension allocation covering increasing pensioners on scale (rise in pension under OROP) and scope (wider pensioned society). In the FY17, the pension allocation rose hugely by 33.9% to Rs 1,28,166 crore (RE) from Rs 95,731 crore in FY16 and 3.9% higher than budgetary allocation of Rs 1,23,368 crore in FY17, indicating first two installment of ‘OROP’ scheme drove the pension expenditure sharply up.

However, the government’s projection of 2.37% higher budgetary allocation to Rs 1,31,201 crore for FY18 seems to be underestimated because of two due installments of OROP and rising scale pressures from revised pay under 7th Pay-commission. The average upward pressures over budgeted estimate in pension expenditure is estimated around 1.08 times higher in last five years. The pension/expenditure ratio (6.6% in FY18 against 6.4% in FY17) displays rising pressure on government’s expenditure.

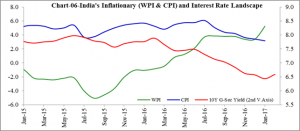

India’s current inflationary (CPI) outlook is stable and comfortable (around 3-year low of 3.17% in January’17) within the target range of monetary policy. However, this easing of inflationary pressure was largely attributed to lower food prices and weaker sentiment in housing sector. But the sharp rise in WPI inflation in recent months (a 30-month high of 5.25% in January’17, after a 17-month stay in deflationary domain) is sufficiently signaling the possibility of sharp upward pressure in the CPI inflation in coming months.

This expectation may also transmit to interest rates in coming months, reflecting from the recent rise in 10-year benchmark G-Sec yield by around 45 basis points in February’17. Any pick up in global risk profile may further put upward pressures on the interest rate trajectory. The divergent trajectories of WPI inflation and CPI inflation in January 2017 strengthens signals of bottoming out possibility of lower CPI inflationary and higher inflationary expectation ahead. The RBI’s change in its policy stance from accommodative to neutral (rationalizing on rising overall global risk profile and possibility of upward pressures on inflationary expectation (4.5% – 5.0% in H1:FY18) in coming quarters), also affirms the same. In that scenario with objectivity of inflation targeting, any rise in Indian monetary policy rate in near term is less likely, but can’t be neglected completely towards the end of 2017-18.

The government proposed further liberalization of FDI policy through structural reforms includes abolition of Foreign Investment Promotion Board (FIPB) and integration of spot market and derivatives market in the agricultural sector for commodities trading. A mechanism of streamline institutional arrangements for resolution of disputes in infrastructure related to construction contracts, PPP and public utility contracts. The budget also proposes exemption of foreign portfolio investor (FPI – Category I & II) from indirect transfer provision, but kept redemption of share or interest rate outside this provision.

With objective of further pursuance of digital economy, the government restricted cash transactions up to Rs 3 Lakh and above this amount, only digital mode of transaction would be permitted. The government is also promoting usage of BHIM Application for fund transfer / payment through incentivizing Referral Bonus Scheme for individuals and a Cash-back Scheme for merchants. The government proposes to set a target of 2500 crore digital transaction for FY18 through other digital modes including UPI, USSD, Aadhar Pay, IMPS and debit cards. The government also proposes lower income consideration for medium tax payers (with business turnover up to Rs 2 crore) at 6% (against 8% of total cash turnover) in case of digital transactions. To strengthen payment infrastructure and keep transaction transparency, the government proposes to create a Payments Regulatory Board in the RBI by replacing the existing Regulatory Board for Payment and Settlement Systems.

The Union Budget 2017-18 looks a good balance between resources and constraints provided stable and sound domestic macroeconomic conditions and discounting short-term external risk. The greater emphasis on recovery and revival of rural economy through basic infrastructure developments like road connectivity, rural housing clusters, time-bound electrification of rural villages and providing drinkable water through pipelines is one of its biggest takeaways. Although this proposal has capacity of massive job creation and improving rural livelihood along with limitation over migration, the expectation of positivity depends on rational and faster implementation of these programme.

Another positive part of budgetary presentation is about electoral funding reforms: maximum cash donation of Rs 2000/- per person, proposal of amending RBI act to enable the issuance of electoral bonds and filing of Income Tax-return within the prescribed time (if implemented successfully, would bring transparency in socio-politico life) and hence improve policy effectiveness. Another major proposal of the budget was removal of plan and non-plan classification of expenditure profile that facilitates a holistic view of fund allocation.

*******