A note on External Commercial Borrowings in India: Rapid growth amidst some vulnerabilities

Parthapratim Pal, Ahana Bose* Download Article- Introduction

External debt flows to developing and developed countries have increased rapidly over the last few years. A study prepared by the Institute of International Finance (IIF) and reported by Reuters indicate that global debt has risen to record US$ 226 trillion, which is more than three times global economic output. The developing world is estimated to have external debt amounting to US$ 59 trillion. This increase in debt to developing countries is largely driven by China, which presently has a debt burden of US$ 35 trillion[1].

India is also receiving increased debt flows. Since 2007-08, India’s external debt stock increased from around US$ 200 billion to hit about US $ 485 billion in end-March 2016 before climbing down to US $ 472 billion in end-March 2017. This has been largely driven by a rapid rise in External Commercial borrowings (ECBs) by Indian firms. Also, in the last one-year, monthly data show that portfolio flows to Indian capital market has been strongly dominated by debt flows. Apart from a few months, net debt inflows have been much higher than equity inflows in the present calendar year (Figure 1).

Figure 1. Foreign Portfolio flows in Debt and Equity in India, (in Rs. billions)

Source: Monthly FPI/FII Net Investments; https://www.fpi.nsdl.co.in

It is notable here that since November 2016, Indian currency has appreciated vis-à-vis US dollar and this has happened despite a widening current account deficit (Figure 2) and weak and intermittent inflows of foreign portfolio capital in the Indian equity markets. Though it is possible that the rupee appreciation has happened due to global weakness of dollar, it can also be hypothesized that increased capital flows to India has contributed to the appreciation of rupee during this period. A validation of this conjecture comes from data on foreign exchange reserves released by the Reserve Bank of India which that India’s foreign exchange reserve rose from US$ 288 billion in end-March 2016 to US$ 398 billion in end-October 2017[2]. As it is evident from figure 1, private capital flows in the equity market has been subdued during this period, and current account balance has been consistently negative (Figure 2). Therefore, it is foreign direct investment or increased inflow in the debt market which are helping in pushing the rupee up.

Figure 2. India’s Current Account Deficit

Source: Reserve Bank of India (RBI)

Against this backdrop, this article looks at the external commercial borrowing by Indian firms in more detail and tries to find out some of the implications of this surge in external debt in this India. It is important to look at this issue because mounting debt in developing countries has become a major concern for the stability of the global financial system. International Monetary Fund (IMF) has repeatedly pointed out that growing global debt poses the greatest risk to global financial markets in medium term.

- Debt flows to Developing Countries after the Financial Crisis

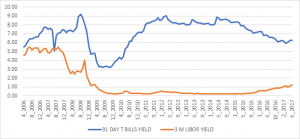

This general rise in debt flows to developing countries can be attributed to the post financial-crisis global economic scenario. One of the policy response to the financial crisis of 2008 has been a slew of accommodative and unconventional monetary policy regimes, including policies like Quantitative Easing (QE) or “large-scale asset purchases” by central banks. These policies increased liquidity in the system and pushed interest rates down to historically low levels in these countries (Figure 3).Domestic policy targets of these monetary policies were largely effective, and they managed to impose some control in the developed markets on the financial turmoil associated with the crisis. However, their global fallout has been quite significant. Increased liquidity and low interest rates in developed countries resulted in excess liquidity which is now crisscrossing national borders chasing higher returns in many countries.

Figure 3. Yield of 91 days Treasury Bond (India) and 3-month LIBOR (in percent)

Source: RBI and Federal Reserve Bank of St. Louis

Relatively higher nominal interest rates and better growth performance of developing countries attracted increased capital flows since 2010. This has pushed up asset prices in many countries of these regions. Easy global liquidity has led to massive commercial and household credit growth in developing countries (IMF 2017)[3]. It is also being argued that post-financial crisis, there has been an increase in propensity to save among developed country consumers. Along with influx of more thrifty Asians in the global economic system, this increased propensity to save in many developed countries is also adding to the pool of global liquidity. As mentioned before, a major share of this increase in commercial debt has gone to China. Bloomberg Intelligence estimates that in China total borrowing climbed to about 260 percent of the economy’s size by the end of 2016, up from 162 percent in 2008. It is estimated that borrowing in China will hit close to 320 percent of GDP by 2021[4].This rapid rise in debt levels have prompted the People’s Bank of China Governor Zhou Xiaochuan to warn about the emergence of possible ‘Minsky moments’ in global financial architecture[5]. Famous US economist Hyman Minsky warned that too much optimism and favourable conditions in financial markets may lead to excessive risk taking by economic agents which may eventually lead to a financial crisis. A ‘Minsky moment’ in China may trigger a significant wave of financial panic across the world. Other economists have also warned about possible repayment problems once central banks in developed countries start shifting towards tighter monetary policy which may lead to higher interest rates in these countries and stronger currencies.

- India and External Commercial Borrowing

India is experiencing debt flows through three major channels. As mentioned before, foreign portfolio investors are investing heavily in Indian debt markets. Indian corporates are raising money from international capital markets through external commercial borrowings (ECBs) and the newly introduced rupee-denominated bonds (the so-called ‘masala bonds’) are bringing in more debt flows to the country. Among these different routes through which external debt is being accumulated, the most important has been the External Commercial Borrowings. ECBs has seen a sharp rise during the post-crisis period. At end March 2006, India’s ECB stock was US$ 26.45 billion, it reached US$ 62 billion at the end of the fiscal year 2008 and by March 2015 the ECB stock crossed US$ 180 billion. Since then it has declined to about US$ 173 billion at the end of the fiscal year 2017 (End-March). According to latest available data (end March 2017), ECBs account for about 36.7 percent of India’s total external debt. Since 2015, India has also allowed issuance of rupee denominated bonds (RDBs) by the corporate sector. The major advantage of RDBs is that the issuer does not bear any currency risk and it is borne completely by the subscriber of the bond. RBI data show that so far 44 Indian firms have raised close to US$ 5.5 billion through RDBs[6]. Taking a cue from Japanese ‘Sushi bonds’, which are fundamentally similar in nature, RDBs are also popularly known as the ‘Masala Bonds’. Recently RBI has imposed some additional guidelines on RDBs. In a June 2017 guideline, RBI has imposed rules capping the maturity limit of bonds less than USD 50 million to three years and bonds above USD 50 million for five years. There is an apprehension that this new rule may restrict the growth of the Masala bond market to a large extent.

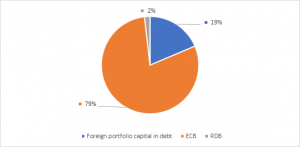

On comparing the foreign inflow of funds generated through debt oriented foreign portfolio flows vis-à-vis commercial borrowings, Figure 4 shows that ECBs have become the most dominant avenue of inflow of foreign debt to India.

Figure 4. Composition of inflow of debt to India from January 2007 to July 2017

Source: Reserve Bank of India and NSDL website

This rapid growth of ECBs has happened in a period when domestic credit growth from banks has been slowing down. In fact, in 2016-17, domestic bank credit growth has touched 5.08 percent, which is the lowest growth rate achieved in the last 60 years[7]. It can be argued that development of alternative sources of finance like the bond market and external commercial borrowings has reduced dependence of the Indian corporate sector on banks for raising money, it must be kept in mind that ECBs come with higher level of risk compared to domestic borrowing. ECBs are denominated in foreign exchange and the borrowers bear the dual risk arising out of movements in foreign exchanges and interest rates. Any shock administered through an external economic event like a hike in the Fed rates, can create a dual impact on the borrowing firms through interest rate and exchange rate effect. As long as international interest rates are low, servicing of ECBs may not pose much challenge for Indian firms. However, there seems to be some early signs of hardening of monetary policy in developed countries. If international interest rates go up, it will increase the debt burden in rupee terms. Also, a hardening of monetary policy by the central banks of developed countries may lead to a depreciation of the Indian currency. This may put additional pressure on servicing of external commercial borrowing. For companies involved in exports, net export earnings in foreign currency can act as a natural hedge against exchange rate movements. But India’s performance on that front also has not been remarkable in the recent past. Earnings and profitability numbers of the Indian corporate sector are not looking up[8]. Increased competition in some of the sectors have reported to have created payment problems on some international borrowings[9].

Reserve Bank of India publishes monthly company level data on ECBs. These data show how stated purpose of ECBs has changed over the years. On examining the end use of ECBs it is found that over the years it has undergone a significant transformation. Traditionally ECBs were taken for funding projects goods, capital expenditures in foreign currencies and some refinancing. In addition, companies used to borrow abroad for meeting miscellaneous needs such as buybacks of foreign currency Convertible bonds (FCCBs), budget financing, leasing and hiring, operating expense, leasing and hiring purchase as well as financial lease. However, of late (2017) refinancing of loans has turned out to be the most popular reasons for taking ECBs by firms. After refinancing, on-lending is the next most popular reason for firms to opt for ECBs (Figure 5). This trend of using less ECBs for Capital Expenditure and Project financing is visible for the last few years. The focus of ECBs seems to have shifted towards refinancing and on-lending in the last few years.

Table 1. Changing purpose of ECBs as stated by borrowing companies

| Purpose | 2010 | 2017 |

| REFINANCING | 8.27 | 35.27 |

| ON-LENDING | 3.06 | 28.86 |

| CAPEX | 60.28 | 16.23 |

| OTHER* | 6.42 | 9.24 |

| PROJECT | 21.95 | 8.51 |

| WORKING CAPITAL | 0.02 | 1.88 |

Source: Compiled from Reserve Bank of India

Notes:* ‘Other’ include: general corporate purpose, microfinance, port, road, telecommunication, urban infrastructure, infrastructure development, rupee expenditure, power, development, construction, cold storage and cold room facility

This changing utilization pattern has raised a few questions. Table 1 clearly shows that in ECBs are not used primarily for capacity creation in the Indian economy. This is not surprising as capital utilization in the Indian economy is down to around 72 percent and private sector investment has been low[10]. Easy availability of foreign debt coupled with lack of avenues of productive domestic investment may have prompted firms to use these resources for financialization and arbitrage. It is possible that the difference in nominal interest rate between India and the developed world is triggering inflows of ECBs in India. This inflow, thereby, is gradually approximating the pattern of carry trade. A paper by Acharya and Vij (2017) has investigated this matter and has concluded that ‘carry-trade’ explain the rise in foreign currency borrowing by Indian firms more that firm-level characteristics. If this is indeed the case, then any movements of domestic and foreign interest rates may trigger changes in this flow. Possible triggers may include a much-demanded interest rate cut in India or a tightening of interest rates in developed countries.

- Concluding Observations

A prolonged period of low interest rates has created a massive global burden of debt. According a CNBC report quoting the Bank for International Settlements, global corporate and household debt reached 138 percent as a share of GDP in 2016, compared to 115 percent in 2007, before the start of the economic downturn. The 2016 figure for advanced economies was 195 percent. Many developing countries like China and India have also taken advantage of this prolonged period of easy money to amass significant amount of external debt. The level of debt in China has reached alarming proportions and given the importance of China in the global financial system, any major problem with debt servicing in that country is likely to have a global fallout. On the other hand, the external debt-GDP burden has been far more modest for India. In case of India, the external debt to GDP ratio has stayed below the 25 percent mark. This level of external debt is manageable and is unlikely to create any major macroeconomic panic in the system. But as monetary tightening is gradually being introduced in developed markets, rising indebtedness and increase in market risk do pose some threat for India. This threat is likely to be more firm-specific. The problem may have its roots in the way ECBs are being used by the Indian corporate sector. Changing usage pattern shows that ECBs are used for financialization rather than real capacity creation. Moreover, performance indicators of the corporate sector have not been very encouraging in the recent past. Earning and profitability numbers have been modest, exports have not shown any major improvement over the past few years, and some of the key sectors like real estate, Information and Communication Technology (ICT) and Pharmaceuticals are going through difficult times. Many of these sectors have fairly high external borrowings. If a shock arises, some firms in these sectors may face problems in managing the dual burden of interest rate and exchange adjustments. While on a macro level, India does not seem to be facing a real ‘Minsky moment’ in near future, some firms in the more difficult sectors may face challenges in financing and repaying their external debt.

********

[1]http://in.reuters.com/article/us-global-debt-iif/worldwide-debt-more-than-triple-economic-output-as-central-bank-shift-looms-idINKBN1CU1V9

[2] Weekly Statistical Supplement, Reserve Bank of India, dated November 03 2017, available at: https://rbidocs.rbi.org.in/rdocs/Wss/PDFs/2T_03111706F9ED53B3EA43E78AE8A5A64287FD27.PDF

[3]Global Financial Stability Report October 2017: Is Growth at Risk? October 2017, IMF.

[4]‘Global economy health at stake as China tries to hold sneeze’, Economic Times, October 30, 2017, available at:

[5]Zhou Warns China Should Defend Against Threat of ‘Minsky Moment’ Bloomberg News, October 19, 2017, available at: https://www.bloomberg.com/news/articles/2017-10-19/zhou-warns-china-should-defend-against-threat-of-minsky-moment

[6] Author’s calculations , compiled based on monthly data available on External Commercial Borrowings on RBI website

[7]‘Credit growth plunges to over 60-year low of 5.1% in FY17’ April 16, 2017, Hindu Business line, available at http://www.thehindubusinessline.com/money-and-banking/credit-growth-plunges-to-over-60year-low-of-5-in-fy17/article9642151.ece

[8] Financial Express says: ‘The July-September earnings of India Inc. continue to be disappointing with the net profit of a sample of 1,296 companies (excluding banks, financials and oil marketing companies) declining by 1.41% compared with the same period last year. A sharp rise in expenditure at 8.28% squeezed operating margins, which also declined 13.38 basis points. Weak order inflows saw domestic revenues of industrial and infrastructure companies decline sharply during the period, which reflects a slowdown in execution, which in turn reflects working capital challenges in the entire value chain due to disruption from the goods and services tax (GST) roll-out.’ See http://www.financialexpress.com/industry/india-inc-quarterly-returns-festive-season-cheer-bypasses-corporates-as-costs-jump-margins-get-squeezed-auto-sector-bucks-trend/934731/

[9]‘Anil Ambani group stocks plunge by up to 12%’November 16, 2017, The Indian Express, available at: http://indianexpress.com/article/business/market/anil-ambani-group-stocks-plunge-by-up-to-12-4939272/

[10] See ‘India’s market rally running on empty’ by Henny Sender, Financial Times, November 16 2017, available at: https://www.ft.com/content/5ef9775a-ca9a-11e7-aa33-c63fdc9b8c6c