Supply Chain Finance and Blockchain: A Potential Integration

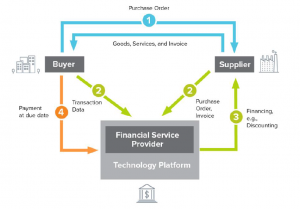

Samit Paul Download ArticleEconomic downturn often creates extreme barriers in day-to-day operations of the firms that are dependent on liquid assets. The situation becomes worse when new loan granting by banks reduces significantly, cost of borrowing increases considerably and liquidity dries up in asset-backed markets. This essentially demands for some solutions which may optimise the working capital management of a firm. Supply Chain Finance (SCF) is one such popular approach that optimises liquidity condition of a firm. SCF, also known as reverse factoring, is well adopted by companies like Coca-Cola, Procter & Gamble or Walmart. Instead of adopting the conventional method of directly paying to the supplier within a given timeline (say, 30 days), firms prefer SCF where they pay certain fee to a bank or a financier to ensure 100% early payment to the supplier (as soon as 10 days). Thereafter, according to the nature of contract, firms repay the amount to bank. The entire exercise creates a “win-win-win” scenario for all three parties involved. The supplier receives early payment, the customer[1] extends the formal payment term with supplier as per their desire and the bank or financier optimises their exposure of risk weighted asset portfolio. Such benefits enhances the acceptance of SCF world-wide which has been further reflected in the estimation of Aite (US research and consultancy group) about the worth of the global SCF market. According to them, the current value of this market is around US$255 billion ($376 billion).

Despite the listed advantages, there are number of concerns which may act as a deterrent for a supplier to proceed with a supply chain contract. The first and most important factor is the ‘control’ aspect which is most probably hidden on the face of the contract. If the customer is a so called “big firm” and the growth of the supplier, to some extent, depends upon the orders generated from the customer, the supplier compulsively has to follow terms and conditions put forward by the customer. Clive Isenberg, chief executive of Octet, has said that – “Once you’re supplying the big end of town and you’re so reliant on that big end of town buying from you and you’re growing with them as they buy from you, you are being constantly pressurised to follow the way they’re going. You’ve got to agree to their payment terms, and if their payment terms means it’s a reverse factoring model, you take it or leave it”. The next important factor in this entire exercise is the ‘trust’. Suppliers need to be watchful about the fact that the bank or financier only register security on their invoices rather than businesses. At the same time, the bank or financier would want to ensure a reasonable payment period as per the contract between the customer and the supplier. Very recently, the ‘big four’ accounting firms have sent a letter to the Financial Accounting Standards Board (FASB) of the US stating that few firms often try to negotiate the payment terms with the suppliers up to 180 or 210 days, whereas historically the payment term was binding from 30 to 60 days at maximum. Hence, the rating agencies, analysts and investors have started scrutinising SCF schemes as the firms (customers) may use this to camouflage problems related to cash flows and put pressure on suppliers for providing discount on invoices. Apart from these ‘control’ and ‘trust’ factors, the third and hopefully the last concern related to SCF is its ‘cost’ of development and maintenance. Since the funding is handled by the customer appointed bank, the bank may work in best interest of their own and the customers rather than in favour of the suppliers. For example – a bank may allow early payment on only a certain amount of invoices in a given month or the customer may keep an upper cap on the same. Besides, the cost related to invoice generation, recording and following-up can be huge at times.

Figure 1: Supply Chain Finance Network; Source: BSR | Sustainable Supply Chain Finance

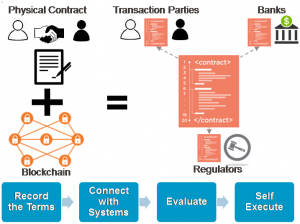

The above mentioned three issues, i.e. control, trust and cost, can be well addressed if the level of transparency and speed of execution in the entire supply can be enhanced significantly. Blockchain technology (BCT) can act as a promising solution in this regard. The BCT helps registering all the transactions cryptographically using a shared database. These blocks of data are chained in such a manner that they become long-lasting and immutable. Furthermore, automated version of contractual agreement (e.g. smart contract) between supplier and customer or between customer and bank provides more transparency in the system. In this system, there is almost no requirement of involving a neutral third party to eliminate related counterparty risk. Even it’s possible to exchange value through BCT among peers. It also reduces cost of due diligence by facilitating KYC process digitally. Along with these improvements, new level of product and information integration would be possible due to open nature of a blockchain. Brigid McDermott, the vice president of Blockchain Business Development & Ecosystem has echoed the same –

“If you talk to supply chain experts, their three primary areas of pain are visibility, process optimization, and demand management. Blockchain provides a system of trusted records that addresses all three.”

Figure 2: Supply Chain Finance with Blockchain; Source: Capgemini Financial Services

Supplier’s benefit with BCT

As time passes, this technology will be gradually available to any small supplier. Thus BCT will make SCF available to suppliers with diversified business. Customers can easily on-board multiple suppliers in single set up. As SCF backed by BCT proliferates at different levels, competition is expected to be significantly enhanced. As marked by Hackett Group, marginal benefits will be of high importance for the suppliers in coming days. According to their analysis, even a small error in invoice processing or delay in delivery may be easily cascaded within SCF network. However, it’s expected to gain huge efficiency in booking transactions, approval of invoices and dealing with foreign currency transactions. In addition, flow of inventory and its tracking will be pretty straightforward. The speed of transactions will be fastened if the relationship between the supplier and customer is strong. For example – prepayment of purchase orders will take place and in case of delay in delivery or defects in goods automated refunds can be initiated.

Customer’s benefit with BCT

According to Mr. Robert Murphy of Forbes, the BCT allows the customers to set up a streamlined SCF with limited resources. Involving multiple suppliers on the same system, the customer will be in a better position to negotiate prices and other terms and conditions related to the agreement in its own favour. With the advent of cloud based technology and smart contracts, it’s possible for a customer to involve some alternative sources of funding, e.g. – credit unions rather than depending only on the handful of banks that offer SCF. Pooling their funds will ultimately reduce administrative costs and overall overhead. This will strengthen the cash flow of both customers as well as suppliers. Another important aspect of SCF for the customer is to obtain a favourable payment term from suppliers as suppliers are using the customer’s credit. BCT will be useful in involving the third-party payer as well in the negotiation process to keep the process more transparent.

Financier’s benefit with BCT

Along with the supplier and customer, BCT also provides banks or financier much desired reliability, speed and increased control in SCF network at a fraction of cost. Since both the original contract and the order placed by customer are on display, bank can readily verify the origin and authenticity of the same. Moreover, if the contract is of any long term events, such as manufacturing or transportation, the progress can be tracked on real time basis. Hence, an easy collaboration between financial service and supply chain activities is catalysed by BCT.

Overall, BCT provides tremendous efficiency in the system. The time of initiation of payment, verification and approval are expected to be drastically reduced. Even due to less manual activity bank fees would be reduced. Therefore, compared to existing practices of SCF, BCT backed SCF would be much cheaper and efficient.

Development and adoption of BCT

Trade finance, now a days, is gradually shifting from a traditional paper based manual model towards a paperless digitized model. In order to achieve this, manual processes are largely replaced with automated transactions. For example, in 2016, export letter of credit has been launched in electronic form for the first time by Wells Fargo and Cargill (commodity trader). Thereafter, since last two years, firms have started implementing BCT in order to support SCF. The CEO of Hugo Boss, Andrea Redaelli, shared with the delegates of SCF forum in 2017 how their company has started implementing BCT to track inventories through a supply chain on experimental basis. Since then, number of start-ups have been coming up with as a provider of BCT in the domain of SCF. Few names among them which are becoming more popular are – Eximchain, Zero1 Capital, Tango Trade, Hijro etc. Some pilot projects on adoption of BCT have already been launched and completed. HSBC has performed financing of soybeans last May using BCT. This is their first transaction in trade finance using this sophisticated technology. Last year, Commerzbank in Germany had also propelled a pilot project on BCT, where their existing business process designed by SAP is integrated with Corda blockchain platform end-to-end.

Challenges in adoption of BCT

The popularity of BCT obviously brings number of questions on board asked by the critics. The most prominent among them is whether BCT can bring a long-lasting and real value in SCF network. In September 2018, the consultancy service firm Deloitte has reported that the technology is yet to come out of the notion of a brilliant idea and being actually implemented in real life. For most of the companies, the adoption of this cloud based technology is still limited for commercial use. According to this report, only nine percent of Chief Information Officers (CIOs) have declared that they are either planning to set up a blockchain project within a year or have already started with one of these. Deloitte has identified some complexities in adoption of this technology. One such complexity is to set up distributed ledger technology (DLT). Besides, processing speed of transactions by the existing systems is also a concern. Another important issue pointed out here is the lack of standards on front.

Apart from operational concerns as discussed above there are also regulatory and legal issues which may crop in. For example, privacy of data is always an important aspect which over the years becoming a major threat. Customers often become conscious when they have to share sensitive financial information (such as cost related information) in the supply chain. But, the main purpose of DLT is to bring transparency among the parties present in the network. This purpose will be completely defeated if the firms hesitate to share information.

Given the potential of BCT in enhancing efficiency of the entire system of SCF some effective planning is required to extract the best results. For example, one can differentiate private blockchains from the public ones. The barrier of transparency created for sensitive information can be somehow controlled by using private blockchain instead of public blockchain. Here, it’s required to grant certain rights to access to certain members of the chain only. One can sincerely hope that with such type of innovative steps, corporates will turn their heads towards this highly efficient technology and avail maximum benefit of SCF.

[1] The terms ‘customer’ and ‘buyer’ have been used interchangeably