The Unending Pain of Student Debt: effect of risk preferences

Birzhan Batkeyev, Debarshi Nandy, Karthik Krishnan Download ArticleThe dangerous and sometimes disastrous consequences of student loan debt are well known. We know for a fact that students with high debt levels are less likely to be entrepreneurs, less likely to own a home when they are 45, and less likely to find an ideal job. The value of a college education is therefore reduced dramatically for those who need to service the debt to pay for it.

However, until recently, few have studied the long-term effects of student debt on the net worth of families burdened by the loans. With my colleagues, Birzhan Batkeyev and Karthik Krishnan, I recently set out to address this gap—showing once again that the very loans that are supposed to help students get a leg up on their financial future, hamper them in myriad ways instead.

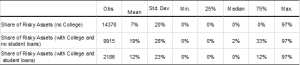

Our groundbreaking analyses show that student loans have a causal effect on personal investment portfolio composition and that, in turn, impacts household net worth dramatically. Our analysis shows that individuals who carry student loan debt are much more likely to keep their investments in lower paying and lower risk alternatives than they are to invest heavily in higher return investments such as stocks or mutual funds (risky assets). The basic distribution of this can be seen in Fig. 1 below, which shows that the average holdings drops by 37% with student loans.

Figure 1: Percentage holding of Risky Assets by College Education & Student Loans

Though stocks and mutual funds provide better return in the longer term, they are also riskier in the short term. The very heavy consequences of missing a student loan debt payment or defaulting on a loan means that families burdened with student debt are often reluctant to risk the budget padding that cash on hand allows them in order to invest in high risk investments. As a result, when they are young, student debtors are not making the investments necessary to amass a nest egg, instead preferring to keep their money in less risky investments—such as bank savings accounts. This tendency can have dramatic effects on a family for generations.

For example, our research shows that student debt leads to suboptimal investments in personal financial assets. The lower investment in high-earning assets leads to missed opportunities and the lack of ability to increase one’s wealth through prudent investments.

Given the recent strong performance of the stock market, this has had disastrous consequences on the net worth of families that carry student loans—consequences that will likely have generational effects—creating a vicious cycle where one generation’s student loans keep another generation in debt as they have to borrow to similarly educate themselves.

We studied students who had enrolled in college before the enactment of the 1998 Higher Education Amendments Act (HEA) to see how their subsequent portfolio allocations responded to their student debt levels.

The 1998 HEA made student debt from federal loans effectively non-dischargeable through personal bankruptcy. In our study, students with non-dischargeable loans invested less in stocks and bonds and more in low return-low risk assets. This “natural experiment” indicates that one can get permanently saddled with student debt obligations regardless of their financial situation.

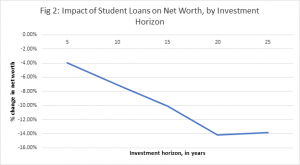

What’s more, our results illustrate that these effects of student loans of personal portfolio investment and on net worth last well beyond the typical ten-year time period that a student loan matures.

Our calculations suggest that a family without student debt, for example, who invest $12,000 in stock and bonds each year, would have a net worth of $831,076 by the time their children were ready for college in 20 years, whereas for the family with student debt the corresponding net worth would be $664,860. That implies that over a 20-year-period, households with student debt would have 14 percent lower net worth than those without student debt. Figure 2 plots this decline in net worth over the investment horizon.

A similar family saddled with student debt that was unable to make a high-return allocation in their investment portfolio would find that they had significantly fewer assets to fund their retirement accounts and for the payment of their own children’s tuition. And thus, a college education which was supposed to set up an individual for upward mobility, becomes instead, a generational drag on income production.

The fix for this is issue complex and will require action at a policy level as well as more innovative solutions from the private sector. For example, recent inroads into redefining student loans as more flexible payment instruments (such as Income Share Agreements or ISAs) could potentially totally alter the huge burden of student debt. Other fixes, at least for the short to medium term, include more transparent information on career and salary outcomes after school, and clear calculation of how long one might be able to pay off their debt after graduation if they choose a particular major at a particular school. More flexibility in student loan repayment options can also help.

Clearly, this is another reason to view negatively the effects of student loans and the harsh terms under which they are granted. Fixing this problem, is doable, but it will take the concerted efforts of policy makers, students and educators alike.