A Bit of Bitcoin

Ashok Banerjee Download ArticleGermany is considering abolishing €500 notes and introducing a €5,000 limit on cash transaction in order to cut off terrorist financing in Europe. In 2012 Spain banned all cash transactions above €2,500. Italy and France have already outlawed all cash transactions above €1,000. Norway declared that it will be cashless by 2020. Many banks in Norway and Sweden do not carry cash. Therefore, increasingly many nations are moving towards electronic payment systems thereby forcing citizens to leave audit trail of every transaction. This is quite useful for the regulators to track any terrorist spend and also for the market analysts to analyse abnormal spending behaviour of consumers. Government would be able, through elective payment systems, to electronically observe and regulate all economic transactions. This would in turn help any government in framing budgets and social schemes. This system of paperless spending would also, hopefully, remove black money from the system. The need for and cost of printing notes will also be reduced. Japan and European Central Bank have lately announced negative interest regime. This implies that banks would charge interest to the depositors. Similarly, the central bank would charge commercial banks for putting money with the central bank. Therefore, negative-interest policy is an effort to force banks to provide more loans and thereby help economic growth. Many investors, in a negative interest territory, would take their money out of the banking system and this is a big worry. Therefore, one way the regulator can force people to keep money with the bank, even in a negative interest scenario, is to make it difficult or illegal to withdraw money. This is possible by banning cash transactions! Another option seriously being considered in Germany is to tax any cash withdrawals in order to encourage people to keep their cash with the banks.

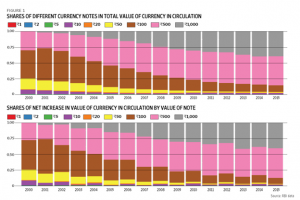

Closer home, the Reserve Bank of India is also contemplating banning older paper currencies (before 2005) and experts are of the opinion that following European examples, India should abolish ₹1000 notes for similar reasons. However, an analysis[1] shows that the cost of banning paper currency of denominations ₹1000 and ₹500 is quite high (Figure 1). It may be observed that the share of larger denomination notes has been on the rise and so is the net increase in the value of currency. Hence if RBI decides to withdraw these paper notes of higher denominations it may have huge impact on the notes in circulation. Also the cost of printing larger denomination paper notes is lower compared to smaller denominations. However, these arguments do not hold ground against larger cause for banning paper currencies. Higher denominated currencies can always be exchanged for lower denominations. Alternatively, the Reserve Bank may encourage electronic payments for higher value consumption/investments.

Use of plastic (electronic payments) or phone has become more widespread globally to make payments mainly for its convenience. But paper currency is popular among many citizens- those who do not trust the banks or the government. Many individuals consider government’s decision to ban cash transaction as interference with one’s freedom- freedom to hold cash outside the banking system. Freedom from government monitoring and control. The urge for such freedom is more in countries under rule of dictators and with weak banking system. This is true that small investors or ordinary citizens would not be affected much by withdrawal of higher denomination currencies from the system.

Source: http://www.livemint.com/Politics/fhNlITluEPxCOHef3GSA6H/Scrapping-Rs500-Rs1000-notes-a-costly-idea.html (accessed on 29 March 2016)

Problem with third-party payment system

All electronic payments presently have to rely on financial institutions serving as reliable third parties to process payments. Typical examples of trusted third parties are Visa, Mastercard, and American Express. When an electronic payment is made for a transaction between a merchant and a consumer, these third parties act as middlemen to settle the payment. The middleman may at any time and for any reason reverse the payment regardless of the contract between trading partners. For example, a customer, not satisfied with the quality of the product, may ask for refund from the merchant. If the merchant fails to oblige, the same customer may approach the ‘trusted’ third-party (Visa, Mastercard etc.) to reverse the payment and the third-party may oblige the customer. Another problem with third-part payment is exorbitant cost that a merchant (or at times a customer) has to bear. The payment processing fee can be anywhere between 1.5% and 2.5% of the merchandise value which could be quite prohibitive for small traders.

Enter Bitcoin

Money started in modern times in gold and silver. In other words, the famous gold standard would require pledging of physical gold against issue of new currency. Later, gold standard was abolished and today the value of money depends on its purchasing power which is largely subject to the whims of planners and government. Money (paper currency) is increasingly becoming notional with wire transfers and payments through debit/credit cards. The computer geeks were working since 1990 to come up with digital currency which would not require any vault or storage facility. The problem with initial experiment was that any digital version of currency was reproducible and hence was vulnerable to double and triple spending. Reproducibility may be a good thing for an object of art- a painting or a song. But unlimited use of a digital instrument is a major impediment as a medium of exchange. A currency is useless unless it is scared and its replication is controlled. Enters Bitcoin!

Bitcoin is a digital currency that operates in a peer-to-peer network without the requirement of a third-party vendor. The payment processing costs for such currency is also negligible. Another advantage with Bitcoin system is almost no possibility of reversal of transaction. The absolute privacy of transaction also makes it attractive. How does Bitcoin work?

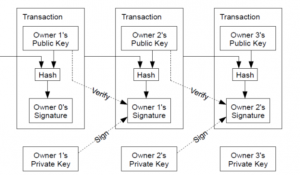

Traditional currencies are mostly issued by central banks. Bitcoin has no central monetary authority. Bitcoin replaces a trust-based model (Visa, Mastercard etc.) with a payment system based on cryptographic proof. Such a system allows two willing parties to trade directly and settle payments without the need for a ‘trusted’ third party. Bitcoin was launched in 2008 by an unknown Japanese with a pseudonym Satoshi Nakamoto[2]. This represents the first successful implementation of a crypto currency. The electronic payments by the Bitcoin are performed by generating Transactions that transfers the Bitcoin between the two peers of the network. Each owner can transfer the coin to the next by digitally signing a hash of the previous transaction and the public key of the next owner and adding these to the end of the coin. A payee can verify the signatures to verify the chain of ownership[3]. Every Bitcoin has an owner and each owner has access to full ledger of all Bitcoins. This helps anyone in the system to check the title of each Bitcoin and thereby ensures that one coin is not used more than once at the same time. Nakamoto put a limit on the number of coins that can be mined (21 million by 2140).

Source: Satoshi Nakamoto, Bitcoin: A Peer-to-Peer Electronic Cash System, https://bitcoin.org/bitcoin.pdf

Interestingly, Bitcoin went live on November 1, 2008 at the peak of financial crisis. Following financial crisis several governments have bailed out companies and banks by printing notes and thereby pumping in more money into the system. It seemed that supply of currency is unlimited and hence lesser purchasing power. But Bitcoins are in limited supply and its public keys are strictly controlled and the ledger updated after every transaction. Its soundness could be checked constantly through instantaneous conversion to other currencies as well as to goods and services. In other words, one can own Bitcoins in digital wallet and use the same for buying goods and services. The market value of Bitcoins change due to demand-supply and also at times due to regulatory intervention. For example, during Greece financial crisis, government seized bank deposits to bail out the system and due to such stress on bank deposits, Bitcoin doubled in value.

Accounting System for Bitcoin

The integrity of the Bitcoin payment system rests on the reliability of the settlement process and ingenuity of every transaction. This is made possible by a robust system of accounting of every transaction in an electronic database, called Blockchain, which uses triple-entry accounting and consensus to establish ownership of bitcoin and validates payment. The traditional double-entry book keeping system mandates that every transaction affects two ledger accounts. Similarly, in double-entry system, a buyer and the seller records the same transaction as ‘payable’ and ‘receivable’ respectively. Over/under statement of revenue or expenses is rampant in corporate financial statements. Auditors, being an independent entity, have to examine and report that financial statements represent a true state of affairs of a firm. In discharging that responsibility auditors are required to match transaction in the ledger with appropriate documents and records to verify the genuineness of a transaction. One may very well imagine that this may become a humongous task for auditors of large and complex organisations.

The triple entry accounting system, as proposed for recording transactions through Bitcoin, is an improvement over the traditional double entry system. In this system all accounting entries involving outside parties (e.g., purchase of goods, payment of tax, utility bills) are cryptographically sealed by a third entry. Take example of a sale transaction. In a double entry system, the seller ‘debits’ cash and ‘credits’ income in one set of books. The buyer ‘debits’ inventory and ‘credits’ cash in a separate set of books. The matter ends there and there is no third party entering the same transaction. This is where the blockchain comes in to tie these two independent set of books of accounts. In a blockchain system, these entries are recorded in the form of a transfer between wallet addresses in the same distributed, public ledger thereby creating an interlocking system of permanent accounting records. Each transaction is thus entered in a distributed way and cryptographically sealed. Hence, misrepresenting any transaction or over/under invoicing is almost impossible. Therefore, in addition to double entry system (which would be carried out in respective books), a third entry will be maintained in an electronic ledger (blockchain) that is authenticated using cryptography and securely sealed. Auditors would find such system of accounting extremely useful as they need not bother about genuineness of any transaction under blockchain method. Hence, they can send quality time in verifying the internal control system and risk measures of any organization.

Bitcoin or any other crypto currency is not free from security concerns and liquidity issues. Money or currency is still popular because of its liquidity- it is available when you need it and it can be used as medium of exchange in most of the transactions. Since Bitcoin is limited in supply and all merchants do not yet accept Bitcoin, its liquidity is an issue to be addressed. Online wallets are more vulnerable to attacks and hence need to be encrypted. Double spending is still a major area of concern in Bitcoin. Though encrypted technology makes Bitcoin less vulnerable to abuse, one would need proper regulation to ensure that terrorist do not create a close network (through miners) to undertake transactions using Bitcoin.

[1] http://www.livemint.com/Politics/fhNlITluEPxCOHef3GSA6H/Scrapping-Rs500-Rs1000-notes-a-costly-idea.html (accessed on 29 March 2016)

[2] Satoshi Nakamoto, Bitcoin: A Peer-to-Peer Electronic Cash System, https://bitcoin.org/bitcoin.pdf

[3] Ibid p 2