Basel III Framework for OTC Derivatives

Ms. Sahana Rajaram Download ArticleThe global financial crisis strongly brought forth the need for transparency and reduced risk in all financial transactions. This aspect has become even more important with relevance to transactions undertaken in the OTC derivatives market, which was identified as one of the potential causes of the global financial crisis. At the Pittsburg Summit in September 2009, G-20 leaders agreed that all standardized OTC derivative contracts should be traded on exchanges or electronic trading platforms, where appropriate and cleared through central counterparties (CCP) by the end of 2012 and additionally they agreed that all OTC contracts should be reported to trade repositories (TRs) and further in 2011 stated that non-centrally cleared contracts should be subjected to higher margin requirements. The Financial Stability Board (FSB) published its report on country specific commitments in six areas of reform in October 2012. They are: 1) standardization of OTC derivatives contracts; 2) central clearing of OTC derivatives contracts; 3) exchange or electronic platform trading; 4) transparency and trading; 5) reporting to trade repositories; and 6) application of central clearing requirements. Global regulators have embarked on a policy to encourage and even drive the settlement of all OTC derivatives through a CCP through either stipulating mandatory central clearing or adequate risk mitigation techniques for the OTC transactions which are not cleared centrally.

The Global Financial Crisis – OTC Derivatives

The failure of Lehmann Brothers Group in 2008 was the major driver for the G20s move to reform the global OTC derivative markets. In addition to this, the bailout of AIG’s loss positions brought forth the absence of regulation in this market which had exacerbated the crisis. Market participants’ losses on account of their exposures to OTC derivatives were largely unquantified as such transactions were not regulated. During the crisis, the lack of transparency in the OTC derivative market and verifiable data on counterparty exposure fueled contagion fears. While CCPs like LCH.Clearnet could smoothly manage the Lehmann positions in the interest rate swaps market by utilizing a small portion of the margins, there were difficulties in unwinding of contracts in areas where CCPs were not involved. The crisis played itself in an acute manner in the market for credit default swaps (CDS), wherein each managed its own counterparty credit risk compared to other derivative markets with CCPs or exchanges.

Genesis of Basel III Norms

The Basel III regulatory set-up is the second major revision in the Basel I rules initially promulgated by the Basel Committee in 1988. Basel norms are a set of standards and practices that were put in place by the Basel Committee of Banking Supervision (BCBS) with the aim of ensuring that banks maintain adequate capital to withstand periods of economic stress and improve risk management and disclosures in the banking sector. The Basel III norms evolved out of the BCBS’s response to the global financial crisis and aimed to strengthen the banking system by eliminating the existing weakness in the Basel II norms. The norms prescribe higher risk weights for risky assets, higher regulatory capital requirements, raising the quality of capital, strengthening the liquidity related requirements and also plugging the weak points in the financial system by promoting CCP clearing of OTC derivatives and reducing dependency on external rating agencies.

Existing Regulatory Frameworks

Currently four regulatory reforms are expected to be relevant to counterparties in OTC derivative transactions: Basel III, Dodd Frank Act, the European Markets Infrastructure Regulation (EMIR) and the Market in Financial Instruments Directives/Regulation (MiFID)/ (MiFiR). Basel III addresses the capital and liquidity requirement of banks and pushes banks towards centralized clearing of their OTC derivative transactions. In the United States, the Dodd Frank Act works towards reducing systemic risk and increasing market transparency by mandating centralized clearing of OTC derivative transactions, margining requirements for such transactions, and improving pre and post trade reporting. In Europe, the European Market Infrastructure Regulation (EMIR) and the Market in Financial Instruments Directives (MiFID) are the two regulatory initiatives sought to be implemented towards reducing systemic risks in the OTC derivatives market. The EMIR focuses on reducing bank’s counterparty risks and mandates increase in margin requirements of bilateral OTC derivative transactions, centralized clearing and trade repository reporting for such transactions. The MiFID which is closely related to the EMIR seeks to address the trading and transparency issues in these transactions.

EMIR (European Market Infrastructure Regulation)

In pursuant to the Agreement between the European Parliament and Council in February 2012 on a regulation for more stability, transparency and efficiency in derivatives, EMIR (European Market Infrastructure Regulation), the Regulation on OTC Derivatives, Central Counterparties and Trade Repositories was adopted and came into force on August 16, 2012. This Regulation helped the European Union to deliver on its G20 commitments on OTC derivatives agreed in September 2009. EMIR affects all entities “established” in the EU (banks, insurance companies, pension funds, investment firms, corporates, funds, SPVs etc.) that enter into derivatives, whether they do so for trading purposes, to hedge themselves against interest rate or foreign exchange risk or to gain exposure to certain assets as part of their investment strategy. The clearing obligation applies to European Union firms which are counterparties to an OTC derivative contract including interest rate, foreign exchange, equity, credit and commodity derivatives unless one of the counterparties is a non-financial counterparty. EMIR has identified the two different groups of counterparties to whom the clearing obligation applies: Financial counterparties (FC) like banks, insurers, asset managers, etc. Entities other than FC are classified as Non-financial counterparties (NFC) which includes any EU firm whose positions in OTC derivative contracts (unless for hedging purposes) exceeds the EMIR clearing thresholds. Any ‘non-regulated’ EU entity will also be an NFC under EMIR. The existing clearing threshold in gross notional value for the various classes of derivatives are EUR 1 billion for equity and credit derivatives and EUR 3 billion for interest rate, foreign exchange and commodity derivative contracts.

The key features of EMIR are as follows:

- Clearing: eligible OTC derivatives must be cleared through a central counterparty (CCP) if transacted between financial counterparties. Certain non-financial counterparties will also have to clear eligible OTC derivative contracts;

- Reporting: counterparties (including CCPs and non-financial counterparties) must report derivatives trades (and any modification or termination) to trade repositories within one working day. This applies to both cleared and non-cleared trades;

- Risk mitigation for non-cleared transactions: financial counterparties and certain non-financial counterparties must have processes which ensure timely confirmation of transactions (where possible, by electronic means) and monitor risk, the latter to include the exchange of collateral or the holding of appropriate capital; and

- CCPs and trade repositories: the authorisation, supervision and regulation of CCPs and trade repositories are provided for.

MiFiD II

Markets in Financial Instruments Directive (MiFiD), which was implemented in equity markets since 2007 brought about significant changes in this market. The introduction of Multilateral Trading Facility (MTF) led to increased competition among trading venues, increased transparency, lowered transaction costs and bid ask spreads and led to faster trading times in equity markets. MIFID II/MIFIR (Markets in Financial Instruments Regulation) is the review of the MIFID to extend its benefits to a wider class of assets other than equity markets in view of the 2009 G-20 commitments in relation to OTC derivatives.

The key initiatives of this framework are introducing a market structure framework to close loopholes and ensure that trading takes place on regulated platforms. Toward this end it introduces a new multilateral trading venue, the Organised Trading Facility (OTF), for non-equity instruments to trade on organised multilateral trading platforms. It has laid down rules to enhance consolidation and disclosure of trading data and establishment of reporting and publication arrangements. It has provided for strengthened supervisory powers, effective and harmonized administrative sanctions and stronger investor protection. In order to encourage competition in trading and clearing of financial instruments, MiFiD II establishes a harmonised EU regime for non-discriminatory access to trading venues and CCPs. It also introduces trading controls for algorithmic trading in order to reduce systemic risks. It also provides for a regime to grant access to EU markets for firms from third countries. The MIFID II/MIFIR after endorsement by the national governments and the European Parliament officially came into effect on July 2014 and is proposed to apply to Member States by January 3, 2017.

Dodd Frank Act

Title VII of Dodd-Frank Wall Street Reform and Consumer Protection Act addresses the gap in U.S. financial regulation of OTC swaps by providing a comprehensive framework for the regulation of the OTC swaps markets. This Act divides regulatory authority over swap agreements between the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC). It provides that the CFTC will regulate “swaps,” and the Commission will regulate “security-based swaps,” and the CFTC and the Commission will jointly regulate “mixed swaps. The key requirements under this include:

- No Federal assistance may be provided to any “swaps entity” (i.e. swap dealers and non-bank major swap participants)

- The CFTC will have jurisdiction over “swaps” and certain swap market participants, and the SEC will have jurisdiction over “security-based swaps” and certain security-based swap market participants. Banking regulators will retain jurisdiction over certain aspects of banks’ derivatives activities (e.g., capital and margin requirements, prudential requirements).

- The Act creates 2 new categories of significant market participants – swap dealers and major swap participants. A ‘swap dealer” is a person who makes the market in swaps, enters into swaps as an ordinary course of business on his own account and is known in the market as a dealer or market maker in swaps. This term excludes persons entering into swaps for their own account individually or in a fiduciary capacity or depository institutions entering into swaps with their customers in connection with originating loans with those customers. CFTC and SEC also need to prescribe de minimis exception to being designated as a swap dealer. A major swap participant is any person who is not a swap dealer, but maintains a substantial position in swaps for any major swap category, whose outstanding swaps create substantial counterparty exposure or is a highly leveraged entity in relation to the capital it holds and is not subject to the Federal banking agency’s capital requirements and maintains a “substantial position” in outstanding swaps in any major swap category.

- A swap must be cleared if the applicable regulator determines that it is required to be cleared and a clearing organization accepts the swap for clearing. Mandatory clearing requirement will not apply to existing swaps if they are reported to a swap data repository or, if in case of absence of one, to the applicable regulator in a timely manner. Further mandatory clearing is exempt if one of the counterparties to the swap is not a financial entity, using swaps hedge or mitigate commercial risk and notifies the applicable regulator how it generally meets its financial obligations associated with entering into non-cleared swaps.

- The extent to which the swap must be cleared, it must be executed on an exchange or swap execution facility, unless no exchange or swap execution makes the swap available for trading.

- Persons who are not eligible contract participants (ECP) must always transact via a swap only through an exchange.

- Swap dealers and MSPs must be registered and will be subject to a defined regulatory regime. The relevant regulators will set the minimum capital and initial and variation margin requirements for swap dealers and MSPs.

The Volcker Rule is included as a part of the Dodd-Frank Act and effective from April 2014 onwards. It prohibits banking entities from engaging in short-term proprietary trading of securities, derivatives, commodity futures and options on these instruments for their own account. Exemption is provided for US Treasury Securities and municipal securities. It has also limited bank ownership in in hedge funds and private equity funds at 3%.

Basel III

The Basel III norms were released in December 2010 and were scheduled to be introduced from 2013 to 2015; but the changes introduced in 2013 further extended the implementation to 2018 and again further to 2019. With regard to the OTC derivatives, the interim norms released by the BCBS in July 2012, aim to incentivize centralized settlement of all OTC derivative transactions through CCPs especially qualifying CCPs (QCCP) who are compliant with the CPSS-IOSCO Principles by assigning risk weights of 2% for all derivative transactions cleared through a CCP. These norms also work towards ensuring that the risk arising from banks’ exposure to CCPs is adequately capitalized. The Basel Committee sought to improve on the interim norms in terms of reducing undue complexity, ensure consistency, incorporating policy recommendations of other supervisory bodies and the Financial Stability Board. Towards this end it released its final policy framework in April 2014 largely retaining features of the interim framework, while adding provisions like a new approach to determine capital requirements for bank exposure to QCCPs, cap on capital charges on their exposure to QCCPs etc.

In addition to this, the Basel III rules following up on the counterparty credit losses incurred by banks during the crisis has introduced a credit valuation adjustment (CVA) in the calculation of counterparty credit risk capital, wherein banks have to calculate an additional CVA capital charge to protect against a deterioration in the credit quality of their counterparty in respect to their OTC derivative transactions. This CVA capital charge is not applicable for the bank’s transactions through a CCP.

OTC Derivative Transactions- Settled Through CCPs

The Basel Committees’ framework for capitalizing exposures to CCPs relies on the “Principles for Financial Market Infrastructures” (PFMIs) released by CPSS-IOSCO to enhance the robustness of CCPs and other essential infrastructure that support global financial markets. The new Rules have elaborated on the two types of exposure that banks need to capitalize when dealing with CCPs- their trade exposure and default fund exposure. Trade exposure implies the current and potential future exposure of a client or clearing member to a CCP from OTC derivatives, securities financing transactions, including initial margin. Default funds or guaranty fund contributions are the funded or unfunded contributions by clearing members to the CCPs mutualized loss sharing arrangements.

The Basel Committee released it interim framework for determining capital requirements for bank exposures to central counterparties in July 2012. These norms relied on the current exposure method to calculate the capital requirement of CCP. It also specified an alternate simplified method for clearing members to calculate the risk weight for their default fund exposures to the CCP. However, the interim norms were criticized for a number of reasons. It was stated that the Method I for calculating the default fund exposures relied on a simple capital methodology, the current exposure method (CEM), to define the hypothetical capital required by the CCP. This was designed for simple and fairly directional portfolios of bank and was thought to be too conservative for the diverse portfolios of CCPs. Further the CEM does not fully recognize the benefits of netting and excess collateral and does not differentiate between margined and unmargined transactions.

Taking into consideration the feedback received from respondents and in order to avoid undue complexity and ensure consistency, where possible, with relevant initiatives advanced by other supervisory bodies, the Basel Committee released its revised standards for capital treatment of bank exposures to central counterparties in April 2014,. These standards are proposed to come into effect from January 1, 2017 onwards. In comparison to the interim standards, the final standard incorporates a new approach for calculating the capital requirements for a bank’s exposure to QCCPs, caps explicitly the capital charges for a bank’s exposures to a QCCP, use of standardized approach for counterparty credit risk to measure the hypothetical capital requirement of a CCP and includes specification of treatment of multilevel client structures.

The broad framework of the Basel III norms for capital requirements for OTC derivatives is elaborated in the following table

| Trade Exposure | Activity | Risk Weight |

| 1. Clearing Member exposure to CCPs

|

||

| Clearing Member of CCP for own purposes | 2% | |

| Clearing Member offering clearing services to clients | 2% also applies to clearing member’s (CMs) trade exposures to CCP in case it’s obligated to reimburse client in case of default of CCP | |

| 2. Clearing member exposures to clients

|

Capitalize its exposure to clients as bilateral trades | |

| Cleared transactions: exposure to clients can be capitalized by applying margin period of risk of atleast 5 days in Internal Model Method (IMM) or Standardized Approach for Counterparty Credit Risk (SA-CCR). | ||

| In case the clearing member collects collateral from a client for client cleared trades and the same is passed on to the CCP, then the clearing member should recognize the collateral for both the CCP-clearing member leg and the clearing member-client leg of the client cleared trade. | ||

| 3. Client exposures | In case a bank is a client of a clearing member and enters into a transaction with the clearing member as the financial intermediary or when it enters into a transaction with a CCP, with a clearing member guaranteeing its performance, then the client’s exposures to the clearing member may receive the same treatment of clearing member exposure to CCPs. | 1.In case client is not protected due to default of the CM or another client of the CM and all other conditions are met then a risk weight of 4% will apply to the client’s exposure to the CM

2. In case the above conditions are not met and the bank is a client of the clearing member, then the bank’s exposure to the clearing member is classified as a bilateral trade. |

| 4.Treatment of posted collateral

|

|

Apply risk weight applicable to the asset – |

| In case collateral is not held in a bankruptcy remote, then bank must recognize credit risk based on creditworthiness of entity holding the collateral | ||

| In case collateral is held by a custodian and is bankruptcy remote then it is not subject to capital requirement for counterparty credit risk. | ||

| If the collateral is held at the CCP on a client’s behalf and is not bankruptcy remote, 2% risk weight is applied | ||

| All collateral posted by the clearing member or client, held by a custodian and bankruptcy remote from the CCP in case of the clearing member and also clearing members and other clients in case of clients, is not subject any capital requirement for counterpart credit risk. | ||

| In case client is not protected from default of clearing member or client of the clearing member then a risk weight of 4% is applicable | ||

| 5.Default Fund Exposures

|

In case there is no segregation between products/business then risk weight for DF contribution to be calculated without apportioning between products | |

| In case segregation exists between product/business types, then risk weight for DF contribution must be calculated for each product/business | ||

| In case the sum of a bank’s capital charges for exposures to a QCCP due to its trade and default fund contribution is higher than the total capital charge in case of a similar exposure to a non-qualifying CCP, then the latter total capital charge would be applied. | The risk weight to the default fund may be calculated considering the size and quality of the CCP’s financial resources, the counterparty credit exposure to the CCP, the structure of the CCPs loss bearing waterfall. The calculation of the capital requirement for the Clearing Member (KCMi) is as per the steps listed in Box 1 | |

| 6. Exposures to Non-qualifying CCPs | Banks must apply the Standardised Approach for credit risk for their trade exposures to a non-qualifying CCP. | Banks must apply a risk weight of 1250% to their default fund contributions to a non-qualifying CCP. |

| BOX 1: Capital Requirement for Default Fund Contribution

The Final Standards have now done away with the ‘simplified method’ for calculating the default fund exposure and now specify only one revised ‘risk sensitive approach’ approach to calculate the capital requirement. These calculations involve the following steps:

The hypothetical capital requirement of the CCP (KCCP) due to its counterparty credit risk exposures to all of its clearing members and their clients is calculated;

KCCP =∑EADi * RW *capital ratio àwhere RW is risk weight of 20% and Capital ratio means 8%

EADi (Exposure at Default) is the exposure amount of the CCP to clearing member CMi, which includes CM’s own transactions and the client transactions that it has guaranteed and all values of the collateral held by the CCP (including the CM’s prefunded default fund contribution) against these transactions, with relation to its valuation at the end of the regulatory reporting date before the margin called on the final margin call of that day is exchanged. This is aggregated over all the clearing member accounts. In case the CM provides client clearing services and the clients’ transactions and collateral are held separately from the CM’s proprietary business, then the EAD for that member is the sum of the clients EAD and the proprietary EAD. In case the sub-accounts hold both derivative and SFT separately then the EAD of that sub-account is the sum of the derivative and SFT EAD. In case the DF contributions of the member are not split with client and proprietary sub-accounts, then the allocation has to be done as per the fraction of the initial margin posted for that sub-account in relation to the total initial margin posted for the account of the clearing member.

In case of derivatives, the EADi is calculated as the bilateral trade exposure the CCP has against the clearing member using the SA-CCR. The collateral of the client with the CCP, for which it has legal claim in event of default of the member or client, including default fund contributions of that member, is used to offset the CCP’s exposure to that member or client through inclusion in the PFR multiplier. In case of SFTs, EAD is equal to max(EBRMi – IMi – DFi;0) where EBRMi is the exposure value to clearing member ‘i’ before risk mitigation, IMi is the initial margin collateral posted by the clearing member with the CCP and DFi is the prefunded default fund contribution by the clearing member upon its default either along with or immediately after his initial margin to reduce the CCP loss.

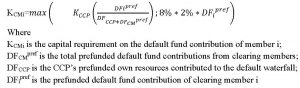

1. Second, calculate the capital requirement of each clearing member

The approach puts a floor of a risk weight of 2% on the default fund exposure. The KCCP and KCMi need to be computed atleast quarterly and also in case of any material changes to the number of exposure of cleared transactions or material changes to the financial resources of the CCP. |

Credit Valuation Adjustment (CVA)

Basel documents describe CVA or the credit valuation adjustment as the fair value (or price) of derivative instruments to account for counterparty credit risk (CCR) or it could also be stated as the market value of counterparty credit risk. In other words, CVA is the risk of loss caused by changes in the credit spread of the counterparty due to changes in the counterparty’s credit quality. Under the Basel II market risk framework, banks were required to hold capital against the volatility of derivatives in their trading book irrespective of the counterparty. There was no requirement to capitialise any risk due to changes in the CVA, and counterparty credit risk was addressed through a combination of default risk and credit migration risk using the CCR default risk charge. During the financial crisis, CVA risk was a greater source of losses than outright defaults as banks suffered losses not from counterparty defaults but primarily from loss on the fair value adjustment on the derivatives as it became apparent that the counterparties were less likely than expected to meet their obligations. Roughly two-thirds of losses attributed to counterparty credit risk were due to CVA losses and only about one-third were due to actual defaults.

To address this gap in the Basel framework, the CVA variability charge was introduced as a part of

Basel III standards by the Basel Committee on Banking Supervision (BCBS) in December 2010. This capital charge is applicable to all derivative transactions that are subject to the risk that a counterparty could default. The CVA capital charge is required to the calculated for all OTC derivative transactions except for transactions with a CCP and securities financing transactions (SFT), unless their supervisor determines that the bank’s CVA loss exposures arising from SFT transactions are material. The framework has set forth two approaches for calculating the CVA capital charge, namely the Advanced CVA risk capital charge method and the Standardised CVA risk capital charge. Both these approaches seek to capture the variability of regulatory CVA that arises solely due to changes in credit spreads without taking into account exposure variability driven by daily changes of market risk factors. Thus the CVA capital charge is calculated on a standalone basis, with no interaction between the CVA book and trading book instruments. The eligible hedges for calculation of CVA risk capital charge are single-name CDSs, single-name contingent CDSs, other equivalent hedging instruments referencing the counterparty directly, and index CDSs. In case CDS spread is not available then proxy spread should be used based on the rating, industry and region of the counterparty.

Another aspect of credit risk is the entity’s own credit risk in derivative transactions i.e. its debit valuation adjustment (DVA), which reflects the potential gain to the entity in its derivative transactions when it defaults as it may not have to post any money to its counterparty in such circumstances. The combination of CVA and DVA is usually referred to as ‘bilateral CVA’. In cases where the counterparty’s and the entity’s risks are independent, firms compute CVA and DVA separately and bilateral CVA is equal to unilateral CVA minus DVA. In case there is dependency between the counterparty risk and the entity’s risk then bilateral CVA is still equal to unilateral CVA minus DVA but their calculations in this case integrate the joint default probabilities of both the counterparty and the entity.

The Basel Committee has released a Consultative Paper, “Review of the Credit Valuation Adjustment Risk Framework” in July 2015 proposing a revision of the CVA framework laid out in the Basel III standards. The existing framework does not take into account the exposure component of CVA risk and therefore does not recognize the hedges that banks put in place to overcome the exposure component of CVA variability. The proposed framework makes is more consistent with the Fundamental Review of the Trading Book (FRTB) regime to better align the regulatory treatment of CVA with banks’ risk management practices. It proposes 2 different proposed frameworks to accommodate different types of banks, first is the FRTB-CVA framework, with 2 approaches- Standardised and Internal Models approaches and the second is the Basic CVA framework with banks not meeting the conditions or not having the internal resources to apply the FRTB-CVA approach. The proposed framework does not recognize the DVA component of bilateral CVA.

Margin Requirements for Non-Centrally Cleared Derivatives

Margin requirements for non-centrally cleared derivatives are required to reduce systemic risk and will help to promote central clearing in these instruments. The Basel Committee along with International Organization of Securities Commissions (IOSCO) in March 2015 released the policy framework which establishes minimum standards for margin requirements for non-centrally cleared derivatives which are proposed to be implemented in a phased manner over a period of four years (starting from September 1, 2016 and implementation fully effective September 1, 2020). The key requirements of the framework are:

- Appropriate margining practices should be in place for all derivatives transactions not cleared by CCPs except for physically settled FX-Forward and Swaps.

- All covered entities (i.e. financial firms and systemically important non-financial entities) engaged in non-centrally cleared derivatives must exchange initial and variation margin on a regular basis as appropriate to the counterparty risks posed by such transactions. The initial margin threshold should not exceed €50 million and has to be applied on a consolidated group level. All margin transfers between parties may be subject to a de-minimis minimum transfer amount not to exceed €500,000. Central banks, sovereigns, multilateral development banks, the Bank for International Settlements, and non-systemic, non-financial firms are not covered entities. At the end of phase-in period all covered entities with the minimum level of such derivative activity i.e. €8 billion will be subject to initial margin requirement.

- Methodologies to calculate Initial and Variation Margin should be consistent across the entities and reflect the potential future exposure in case of initial margin and current exposure in case of variation margin and also ensure that all the counterparty risk exposures are covered with a high degree of confidence. Initial margin should be collected at the outset of a transaction and thereafter in case of changes in the potential future exposure in terms of addition or subtraction of trades in the portfolio. In case of variation margin the entire amount necessary to fully collateralize the mark-to-market exposure of the non-centrally cleared derivatives must be exchanged.

- Assets collected as collateral for initial and variation margin should be highly liquid and after accounting for an appropriate haircut should hold their value in times of financial stress. The collateral should not have a significant correlation with the creditworthiness of the counterparty or the underlying non-centrally cleared derivative portfolio. Securities issued by the counterparty or its related entities should not be accepted as collateral. List of eligible collateral include Cash, High-quality government, central bank securities, corporate bonds and covered bonds, Equities included in major stock indices and gold. The BCBS and IOSCO have listed a standardised schedule of haircuts for these assets.

- The initial margin should be exchanged on a gross basis and should be held in such a way that the margin is immediately available to the collecting party in the event of the counterparty’s default. The posting party should also be protected under the applicable law in case of bankruptcy of the collecting party. However cash and non-cash collateral collected as variation margin may be re-hypothecated, re-pledged or re-used.

- Transactions between a firm and its affiliates should be subject to appropriate regulation in a manner consistent with each jurisdiction’s legal and regulatory framework.

- Regulatory regimes should interact so as to result in sufficiently consistent and non-duplicative regulatory margin requirements for non-centrally cleared derivatives across jurisdictions.

- These margin requirements are being introduced in a phased manner to align systemic risk reduction and incentive benefits with the implementation costs.

- The requirement to exchange variation margin will become effective from September 1, 2016 for any covered entity in a group whose aggregate month-end average notional amount of non-centrally clear derivatives with any covered entity for March, April, and May of 2016 exceeds €3.0 trillion. It will apply to only new contracts and for other contracts it would be subject to the bilateral agreement. From March 1, 2017 onwards all covered entities will be required to exchange variation margin.

- The stages for the exchange of two-way initial margin with a threshold of €50 million would be as follows: It would apply to the aggregate month-end average notional amount of non-centrally cleared derivatives for March, April, and May of the year under consideration of a covered entity subject to it transacting with another covered entity satisfying similar conditions

- From September 1, 2016 to August 31, 2017 – €3 trillion

- From September 1, 2017 to August 31, 2018 – €2.25 trillion

- From September 1, 2018 to August 31, 2019 – €1.5 trillion

- From September 1, 2019 to August 31, 2020 – €0.75 trillion

- From September 1, 2020 onwards – €8 billion

Since the release of this policy framework various regulators in the Unites States, European Union, Australia, Canada and Japan have proposed rules for non-cleared OTC transactions largely consistent with the final policy framework with some divergence.

India-Current regulatory and Infrastructural Framework for OTC Derivatives

One of the key takeaways for India from the global financial crisis has been the relative insularity of the Indian financial system from the unraveling crisis in the global markets. This was even more prominent in the case of the OTC derivative market which faced the brunt of the crisis in those markets. The small size of the OTC derivative market, low level of complexity in products and regulatory structure has resulted in orderly development of the market in India. While OTC derivatives in the forex market have been operational since long, the interest rate OTC market was launched in 1999 for trading in interest rate swaps (IRS) and forward rate agreements (FRA). The RBI Amendment Act 2006 has laid down the regulatory framework for OTC interest rate, forex and credit derivatives. The responsibility for the regulation of all interest rate, forex and credit derivatives, including OTC derivatives, vests with the Reserve Bank of India (RBI). Further with these markets being dominated by banks and other entities regulated by the RBI, trading in these derivative instruments is restricted to atleast one counterparty being a RBI regulated entity, which has enabled the close monitoring of this market.

The RBI in conjunction with market participants has undertaken many reform measures to implement the vision of the G20 reforms mandate in the OTC derivative market. With a view to guide the implementation of key reforms in this market, an implementation group for OTC derivatives was constituted on the directions of the Sub Committee of the Financial Stability and Development Council (FSDC) with representatives from the Reserve Bank of India and market participants, under the Chairmanship of Mr. R. Gandhi Executive Director, RBI. The

Report of this Implementation Group has served as the roadmap for the implementation of the reform measures in the OTC derivatives in India.

Trading, Reporting and Clearing Structure

In the interest rate derivative market, RBI has facilitated the development of the trading, reporting and settlement infrastructure. In 2007 based on RBI’s requirement, the Clearing Corporation of India (CCIL), the CCP which is regulated and supervised by RBI, started a Trade Reporting platform for all transactions in the OTC interest rate derivatives market. While initially reporting was limited to inter-bank transactions, all client level IRS transactions are also mandatorily reported on CCIL’s Trade Repository since December 2013. Further in order to strengthen and mitigate the risks involved in this market, CCIL operationalized a clearing and settlement arrangement for OTC rupee interest rate derivatives on a non-guaranteed basis in 2008. CCP based clearing for IRS transactions have been operationalized by CCIL since March 2014. The ASTROID trading platform was launched in August 2015 for trading in OTC derivative trades. In May 2016, the RBI acting on in its First Bi-Monthly Policy Statement for 2016-17 permitted entities regulated by SEBI, PFRDA, NHB and IRDAI to trade in interest rate swaps on electronic trading platforms. RBI has also specified that CCIL is the approved counterparty for IRS transactions undertaken on electronic trading platforms, where CCIL is the central counterparty.

In case of standardization, while transactions in the Overnight Index IRS market have been standardized as per the regulatory mandate, standardization has not been mandated as of yet for other interest rates and forex OTC derivative instruments. In case of the forex derivative market, CCIL has been undertaking settlement of inter-bank forex forward trades as reported to it since November 2002 from the Spot date onwards. CCIL started providing guaranteed settlement to forex forward trades from trade date onwards from December 2009. Since June 2014, all forex forward trades are mandatorily settled at CCIL. All inter-bank and client level OTC foreign exchange derivatives are now mandatorily reported on CCIL’s Trade Repository from December 2013 onwards. In case of trading, some maturities of forward trades can be concluded on CCIL’s FX-SWAP trading platform and the platform developed by CCIL and Reuters is available for trading in fx swaps.

Basel III OTC Derivatives Guidelines – Implementation in India

The first initiative with regard to the capital requirements for banks’ exposure to central counterparties was in July 2013, when RBI issued the first set of guidelines aimed at prescribing the capital requirements for bank exposure to central counterparties. For the first time, the guidelines differentiated between the capital requirements in case of banks’ exposure to qualified CCPs (QCCP) and non-qualified CCPs. The notification proposed that the guidelines have become effective from January 1, 2014 onwards. However, the implementation of the Credit Valuation Adjustment (CVA) risk capital charge for OTC derivatives was deferred from April 1, 2013 to January 1, 2014 and further to April 1, 2014 in view of the delay in the operationalization of the mandatory inter-bank forex forward guaranteed settlement through CCIL as the central counterparty.

Pre-existing norms

Under the earlier regulations, the derivative exposures of banks were classified as market related off-balance sheet exposures. These included interest rate contracts, foreign exchange contracts and other market related contracts specifically allowed by the RBI. Only foreign exchange contracts with original maturity of 14 calendar days and instruments traded on futures and option exchanges were subject to mark-to-market and margin payments. The exposures to CCPs, on account of derivatives trading and securities financing transactions outstanding against them were assigned zero exposure value for counterparty credit risk. A CCF (credit Conversion factor) of 100 per cent was to be applied to the banks’ securities posted as collaterals with CCPs and the resultant off-balance sheet exposure were assigned risk weights appropriate to the nature of the CCPs. In the case of CCIL, the risk weight was 20 per cent and for other CCPs, it was as per the ratings assigned to these entities. The credit equivalent amount of a market related off-balance sheet item, whether held in the banking book or trading book had to be determined by the current exposure method. The deposits kept by banks with the CCPs attracted risk weights, 20% in case of CCIL and as per external ratings for other CCPs.

Current Capital Requirement Norms

The existing guidelines for bank exposure to CCPs came into effect from January 1, 2014. The key features of the existing guidelines are:

| Trade Exposure | Activity | Risk Weight | |

| 1. Clearing Member exposure to QCCPs

|

Clearing Member of CCP for own purposes |

2% risk weight based on bank’s trade exposure to QCCP, calculated by Current Exposure Method (CEM) |

|

| 2. Clearing member exposures to clients | Capitalize its exposure to clients as bilateral trades | ||

| In order to recognize the shorter close-out period for cleared transactions, clearing members can capitalize the exposure to their clients by multiplying the EAD by a scalar which is not less than 0.71. | |||

| 3. Client exposures to Clearing Member | In case a bank is a client of a clearing member enters into a transaction with the clearing member as the financial intermediary or when it enters into a transaction with a QCCP, with a clearing member guaranteeing its performance, then the client’s exposures to the clearing member may receive the same treatment of clearing member exposure to QCCPs. | 1.In case client is not protected due to default of the CM or another client of the CM and all other conditions are met and the CCP is a QCCP, then a risk weight of 4% will apply to the client’s exposure to the CM

2. In case the above conditions are not met and the bank is a client of the clearing member, then the bank’s exposure to the clearing member is classified as a bilateral trade. |

|

| 4.Treatment of posted collateral

|

|

Apply risk weight applicable to the asset – Banking Book or Trading Book | |

| In case collateral is not held in a bankruptcy remote, then bank must recognize credit risk based on creditworthiness of entity holding the collateral | |||

| In case collateral is held by a custodian and is bankruptcy remote then it is not subject to capital requirement for counterparty credit risk. | |||

| If the collateral is held at the CCP on a client’s behalf and is not bankruptcy remote, 2% risk weight is applied | |||

| In case client is not protected from default of clearing member or client of the clearing member,

but all other conditions mentioned in paragraph on “client bank exposures to clearing members” then a risk weight of 4% is applicable |

|||

| 5.Default Fund Exposures

|

In case there is no segregation between products/business then risk weight for DF contribution to be calculated without apportioning between products | Clearing Members may apply a risk weight of 1250% of their default fund exposures to the QCCP, subject to an overall cap on the risk-weighted assets from all its exposures to the QCCP (i.e. including trade exposures) equal to 20% of the trade exposures to the QCCP i.e. the risk weighted asset both bank i’s trade and default fund exposure to each QCCP are equal to

* TE)} Where TEi is bank i’s exposure to the QCCP and DFi is bank’s pre-funded contribution to QCCP’s default fund.

|

|

| In case segregation exists between product/business types, then risk weight for DF contribution must be calculated for each product/business | |||

| 6. Exposures to Non-qualifying CCPs | Banks must apply the Standardised Approach for credit risk for their trade exposures to a non-qualifying CCP. | Banks must apply a risk weight of 1250% to their default fund contributions to a non-qualifying CCP. |

Based on the framework finalized by the Basel Committee on Banking Supervision (BCBS), RBI released the revised guidelines to better capture the risk arising from OTC and also centrally cleared transactions in June 2016. The new guidelines are proposed to be implemented from April 1, 2017.

Comparison- Revised RBI and Basel III norms – Bank Exposures to CCPs

| Basel | RBI | |

| Applicability | Exposure to CCP in case of OTC, exchange traded derivatives and SFTs. | –do— |

| A. Trade Exposure | ||

| 1. Clearing Member exposure to CCPs | Bank acts as clearing member of CCP for its own purposes -risk weight of 2% | –do— |

| Exposure amount to be calculated using SA-CCR | Exposure amount to be calculated using IMM or SA-CCR. | |

| 2. Clearing Member Exposure to Clients | Capitalize its exposure to clients as bilateral trades irrespective of whether it guarantees the trade or acts as an intermediary | –do— |

| Due to the shorter close-out period for cleared transactions, clearing members can capitalize the exposure to their clients by applying margin period of risk of atleast 5 days while computing the trade exposure using the SA-CCR. | Due to the shorter close-out period for client cleared transactions, exposure to clients can be capitalized by applying margin period of risk of atleast 5 days in IMM or SA-CCR. | |

| 3. Client exposures to Clearing Members

|

Bank is client of clearing member and the clearing member is the intermediary in the transaction between the bank and the QCCP, then its exposure to the clearing member will receive treatment similar to “a clearing member’s exposure to a QCCP”. Similarly the client’s exposure to a CCP, guaranteed by a clearing member will receive a similar treatment. | –do— |

| The collateral of the bank with the CCP must be held such that there is no loss to the client due to either default or insolvency of the clearing member, or his other clients and also the joint default or insolvency of the clearing member and any of its other clients | ||

| In case of the default or insolvency of the clearing member, then the positions and collateral with the CCP will be transferred at market value, unless the client requests a close out at the market value. | In case of the default or insolvency of the clearing member, then the positions and collateral with the CCP will be transferred at market value, unless the client requests a close out at the market value. | |

| When the client is not protected from losses in case default or insolvency of the clearing member and one of its clients jointly, but all the conditions above are met, then a risk weight of 4% is applied to the client’s exposure to the clearing member | –do— | |

| In case the client bank does not meet the above requirements, then it would need to capitalize its exposure to the clearing member as a bilateral trade | ||

| 4. Treatment of posted collateral | Apply risk weight applicable to the asset | –do— |

| In case collateral is not held in a bankruptcy remote, then bank must recognize credit risk based on creditworthiness of entity holding the collateral | ||

| In case collateral is held by a custodian and is bankruptcy remote then it is not subject to capital requirement for counterparty credit risk. | ||

| If the collateral is held at the QCCP or a clearing member on a client’s behalf and is not bankruptcy remote, 2% risk weight is applied to collateral included in the definition of trade exposures. This collateral must also be accounted for in the Net Independent Collateral Amount (NICA) while computing exposure using SA-CCR. | ||

| In case client is not protected from default of clearing member or client of the clearing member then a risk weight of 4% is applicable | ||

| B. Default Fund | ||

| 5.Default Fund Exposures | In case there is no segregation between products/business, then risk weight for DF contribution to be calculated without apportioning between products | –do— |

| In case segregation exists between product/business types, then risk weight for DF contribution must be calculated for each product/business | ||

| a. The risk weight to the default fund may be calculated considering the size and quality of the CCP’s financial resources, the counterparty credit exposure to the CCP, the structure of the CCPs loss bearing waterfall | ||

| b. Clearing members need to calculate the risk weight to their default fund contributions on the basis of the risk sensitive formula specified in Box 1 above. | Same computations specified also by RBI also except that the capital ratio has been specified at 9% instead of the 8% as per the Basel norms. | |

| c. In case the bank’s total capital charges for exposures to a QCCP for trade exposure and default fund contribution is higher than the capital charge that would be applied for a similar exposure to a non-qualifying CCP, then the latter capital charge would be applied. | –do— | |

| 6. Exposures to Non-qualifying CCPs | Banks must apply a risk weight of 1250% to their default fund contributions to a non-qualifying CCP. | –do— |

| Margin requirements for Non-Centrally Cleared Derivatives

RBI in its First Bi-Monthly Monetary Policy Statement for 2016-17 had announced the release of a consultative paper outlining the Reserve Bank’s approach to implementation of margin requirements for non-centrally cleared derivatives. The paper was released in May 2016 and most of the proposals here are in line with above mentioned BCBS-IOSCO standards. The key features are: · The initial and variation margin will generally apply to all non-centrally cleared derivatives, with atleast one party under the regulatory preview of RBI. Physically settled foreign exchange forwards and swaps and transactions involving exchange of principal of cross currency swaps, will not attract initial margin requirements. · Margin requirements to be applied in a phased manner, to all financial entities (like banks, insurance companies, mutual funds, etc.) and certain large non-financial entities (having aggregate notional non-centrally cleared derivatives outstanding at or above Rs. 1000 billion on a consolidated group basis). No margin requirements for derivative transactions with sovereign, central bank, multilateral development bank and Bank for International Settlements. · Types of margins o Variation margin to protect against change in mark-to-market value of the derivatives and initial margin to protect against potential future exposure. The computation and exchange of variation margin should be done bilaterally on a daily basis. o Threshold for exchange of initial margin is Rs. 350 crore and would be applicable on a consolidated group level. Margin transfers between parties would be subject to a minimum transfer amount of Rs. 3.5 crore. The initial margin would be required to be exchanged bilaterally by the counterparties on a gross basis. o While initial margin is to be implemented in a phased manner, entities required to fulfill margin requirements need to have notional amount of non-centrally cleared derivative transactions outstanding of atleast Rs. 55,000 crore for initial margin requirements to be made applicable. · Margin Computation o Initial margin requirements to be calculated through 2 approaches: Standardised method (multiplying RBI specified factors with notional amount of the derivative transactions) and quantitative risk models after due validation by RBI. The Standard method requires computation of initial margin based on following:

Initial margin requirement calculated through models should be atleast 80% of the amount computed using the above schedule. o Amount of variation margin is dependent on mark-to-market value of the derivative transaction and needs to be exchanged daily on a transaction-by-transaction basis. · The eligible collateral for exchange of the margins are Cash, Securities issued by Central Government and State Governments and Corporate bonds of rating BBB and above. · Appropriate haircuts, either model based or those specified by RBI, have to be applied to the collateral collected under initial margin. · Initial margin collected should not be comingled with other assets of the collecting party and it should be used only for the specific purpose of meeting the losses arising from default of margin giver. There is no need to separate margin collected as variation margin from other assets of the collecting party and it could also be re-hypothecated, re-pledged or re-used without any limitation. · Intra-group derivative transactions are exempted from scope of margin requirements, while in case of cross border transactions, RBI would co-operate with other regulators for application of appropriate treatment. · Transactions booked in foreign locations would follow margin requirements of foreign jurisdiction in case it is consistent with global standards else follow the requirement specified above. · The new requirements would involve operational enhancements and additional amounts of collateral entailing liquidity planning. Hence the new requirements will be implemented in phased manner. o Variation Margin: From September 1, 2016 entities whose notional amount exceeds Rs. 200 trillion have to exchange variation margin when transacting with an entity with similar scope for contracts entered into after September 1, 2016. From March 1, 2017 onwards, all entities within the scope have to exchange variation margin for contracts entered after that date. o Initial Margin: The requirement to exchange two-way initial margin with a threshold of up to INR 350 crore will be phased in as follows for all entities on the basis of their aggregate month-end average notional amount of non-centrally clear derivatives for the March, April and May of the year under consideration § From September 1, 2016 to August 31,2017 – notional amount exceeding INR 200 trillion § From September 1, 2017 to August 31, 2018 – notional amount exceeding INR 150 trillion § From September 1, 2018 to August 31, 2019 – notional amount exceeding INR 100 trillion § From September 1,2019 to August 31, 2020 – notional amount exceeding INR 50 trillion § On a permanent basis (i.e. from September 1, 2020) notional amount exceeding INR 550 billion

|

Impact Assessment of OTC Derivative Regulatory Reforms

The assessment of the macroeconomic implications of the OTC regulatory reforms was undertaken by the Macroeconomic Assessment Group on Derivatives (MAGD) under the aegis of the BIS. Comparing and assessing the long term consequences of the reforms programme the Group finds the main beneficial effect is the reduction of forgone output due to lower frequency of financial crisis and the main costs to be expected reduction in economic activity due to higher price of risk transfer and other financial services.

The main costs associated with the shift to the new regulatory regime are:

- Costs of complying with new capital and collateral requirements and increases in the operational expenses inherent in central clearing.

- The increase in capital requirements from the combination of CVA charge for uncollateralized OTC derivative exposures and trade and default fund exposures to CCPS.

- Additional margin for OTC derivatives for non-centrally cleared trades or reallocation of exposures to CCPs.

- The fees paid to CCPs for clearing and collateral management.

- The demand for high quality collateral for central clearing and for margin requirements of non-centrally cleared derivatives could put pressure on pricing of high quality collateral and increase the costs of such transactions.

- The extraterritorial application of regulatory frameworks for example the prescriptive rules under EMIR and the Dodd-Frank Act may prevent European/US banks from participating in third country CCPs currently not recognized by them. This could lead such CCPs being treated as non-qualifying leading to higher regulatory capital requirements for trade and default fund exposure, acting as a disincentive for OTC derivatives trading.

The benefits are:

- These regulatory reforms collateralize the vast majority of exposures in the OTC derivatives market.

- This leads to lower CVAs against these exposures and correspondingly increase the scale of severity of events required to precipitate a crisis.

- Reduction of counterparty risk results in reducing the too-big-to-fail problem related to systemically important banks.

- It could lead to better price differentiation and competition as greater standardization of products and lower counterparty risk will facilitate comparison of pre-trade prices.

- Central clearing and use of collateral will lead to increasing unimportance of individual counterparty information.

Other Implications

An IMF study (Making Over-the-Counter Derivatives Safer: The Role of Central Counterparties), has estimated that collateral requirements related to initial margin and default fund contributions to amount up to $150 billion, assuming that existing bilateral OTCD contracts (credit default swaps, interest rate derivatives, other derivatives) are moved to CCPs. It states that the inability of banks to re-use through re-hypothecation and the possible fragmented CCP space could pose issues with a few sovereign’s debt management strategies. End-users of OTC derivatives could buy less perfect hedges by using cleared or standardised derivatives against bespoke and expensive non-cleared derivatives, exposing themselves to more risk on their balance sheets. The market could move towards Futurization i.e. shift from bilateral OTC markets to centrally cleared exchange-traded futures-style contracts. In addition to this the Basel III regulatory requirements, especially that of the leverage ratio has acted as an incentive for banks to reduce their derivative books and there has been an increase in compression activity in the interest rate derivative activity. This has resulted in a decrease in the notional principal outstanding is this market. As per the Global OTC derivative statistics released by the BIS, the IRD notional outstanding has decreased from USD 584.8 trillion at end 2013 to USD 384 trillion by end 2015.

Implementation Status

As per the final guidelines issued by the Basel Committee in April 2014, the standards for the capital treatment of bank exposures to central counterparties will come into effect on January 1, 2017. However, member countries of the Basel Committee on Banking Supervision (BCBS) seem to be making slow but steady progress in the process of adoption of these norms.

As per the Financial Stability Board’s Tenth Progress Report on Implementation of OTC Derivatives Market Reforms released in August 2016, many countries have put in force the legislative framework or other authority in place to implement the G20s OTC derivatives reform commitments. The implementation framework is the most complete in case of trade reporting and higher capital requirements for non-centrally cleared derivatives (NCCDs). Central clearing frameworks and to a lesser degree margining requirements for NCCDs have been or are being implemented, while trading platform systems were largely underdeveloped in most frameworks.

A substantial share of new OTC derivatives are estimated to be covered by reporting requirements in many jurisdictions, with the coverage most comprehensive for interest rate and forex derivatives. According to the Report, all but four FSB jurisdictions had requirements in force to cover 80-100% of the interest rate derivative transactions. As at end June 2016, TR or TR like entities were authorized and were operating for atleast some asset classes in 21 of the 24 FSB jurisdictions.

There has been progress in the move to promote central clearing, with 14 jurisdictions evolving a legislative framework with respect to over 90% of OTC derivative transactions to determine the products to enforce central clearing. Higher capital requirements for non-centrally cleared derivatives (NCCD) are in place in 20 of the 24 FSB member jurisdictions, which are now currently applicable to over 90% of OTC derivatives transactions. While the BCBS-IOSCO standards for margin requirements as scheduled to be phased in starting from September 2016, only 3 jurisdictions have scheduled to enforce the requirements with several jurisdictions announcing delays in implementation. As at end-June 2016, 19 jurisdictions have at least one CCP that was authorised to clear at least some OTC interest rate derivatives.

In the case of implementing the G20 commitment to promote electronic platform trading, the Report finds that while almost all jurisdictions have established a legislative basis towards this end, less than half of FSB members have evolved comprehensive assessment standards or criteria.

Conclusion

The sheer breadth and depth of new regulations in the OTC derivative market, ranging from Basel III OTC regulations, Dodd-Frank, EMIR etc., create significant challenges for banks, brokers and other major participants in the global derivatives market. The imposition of mandatory margins for both cleared and non-cleared transactions and demand for high quality collateral by CCP could pose collateral management challenges. The bifurcation of the market model between CCP settled and bilateral transactions could increase operational complexity. Finally CCPs could face challenges in holding and servicing the increased amount of collateral in their custody. Despite these challenges, the coordinated effort by global regulators and standard setting bodies in the OTC derivative market following the global financial crises bloodbath is an important milestone in the history of the global derivative market. Implementation of these regulatory measures is expected to be a stepping stone to achieve the goal of maintaining the integrity and stability of the global financial markets, and preventing the recurrence of financial crises in the future.

References:

- Basel Committee on Banking Supervision: The standardised approach for measuring counterparty credit risk exposures, March 2014

- The New Standardized Approach for Measuring Counterparty Credit Risk: Sara Jonsson and Beatrice Ronnlund, May 24, 2014

- Basel Committee on Banking Supervision- Board of the International Organization of Securities Commissions: Margin requirements for non-centrally cleared derivatives, March 2015, September 2013

- Macroeconomic Assessment Group on Derivatives: Macroeconomic impact assessment of OTC derivatives regulatory reforms, August 2013

- Bank for International Settlements: Regulatory reform of over-the-counter derivatives: an assessment of incentives to clear centrally- A report by the OTC Derivatives Assessment Team, established by the OTC Derivatives Coordination Group, October 2014

- JP Morgan: Regulatory Reform and Collateral Management- The Impact on Major Participants in the OTC Derivative Markets, 2011

- Basel Committee on Banking Supervision – Consultative Document: Review of the Credit Valuation Adjustment Risk Framework, July 2015

- Capital Requirements Directive IV Framework Credit Valuation Adjustment (CVA): Allen & Overy Client Briefing Paper 10, January 2010

- Financial Stability Review: OTC Derivatives: New Rules, New Actors, New Risks, April 2013

- Deloitte- EMEA Centre for Regulatory Strategy: OTC Derivatives – The new cost of trading, 2014

- Reserve Bank of India: Discussion Paper on Margin Requirements for non-Centrally Cleared Derivatives, May 2016

- Sea of Change-ISDA – Dodd Frank Act v. EMIR – Business Conduct Rules-Clifford Chance, October 2012

- Morrison & Foerster: The Dodd-Frank Act: a cheat sheet, 2010

- Bank for International Settlements: OTC derivatives statistics at end-December 2015- Monetary and Economic Development, May 2016

- ISDA Research Note: The Impact of Compression on the Interest Rate Derivatives Market, July 2015

- Shyamala Gopinath: Over-the-counter derivative markets in India – issues and perspectives, Article by Ms Shyamala Gopinath, Deputy Governor of the Reserve Bank of India, published in Financial Stability Review, Bank of France, July 2010

- Reserve Bank of India: Implementation Group on OTC Derivatives Market Reforms, February 2014

- PWC: MiFID II Driving change in the European securities markets, 2011

- Basel Committee on Banking Supervision: Capital requirements for bank exposures to central counterparties, July 2012

- CVA the wrong way: Dan Rosen and David Saunders, February 2012

- Baker & Mckenzie: The Basel III Reforms to Counterparty Credit Risk: What these Mean for your Derivative Trades, October 2012

- Reserve Bank of India: Capital Requirements for Banks’ Exposures to Central Counterparties, July 2, 2013

- RBI Notifications

- Basel Committee on Banking Supervision: Capital requirements for bank exposures to central counterparties, April 2014

- Shearman and Sterling: Basel III Framework: The Credit Valuation Adjustment (CVA) Charge for OTC Derivative Trades, November 2013

- European Banking Authority: EBA Report on CVA, February 25, 2015

- Financial Stability Board: OTC Derivatives Market Reforms, Ninth and Tenth Progress Report on Implementation, July 24, 2015, November 4, 2015

- OECD: Regulatory Reform of OTC Derivatives and Its Implications for Sovereign Debt Management Practices-Report by the OECD Ad Hoc Expert Group on OTC Derivatives – Regulations and Implications for Sovereign Debt Management Practices, OECD Working Papers on Sovereign Borrowing and Public Debt Management No.1