The Changing Dynamics of Debt Financing in India

Payal Ghose and N Aparna Raja Download ArticleDebt financing basically refers to a business raising capital (operating or other) by borrowing. The global financial crisis (GFC) that originated in the credit markets of advanced economies (AEs) and the massive liquidity enhancing measures taken by the major central banks to counter, it has ironically resulted in higher levels of borrowing in all major economies relative to GDP than they did in 2007. The GFC has also altered the financing decisions of corporates in emerging economies (EMEs) like India with increasing debt financing accompanied by slackening in bank financing.

As per the International Monetary Fund (IMF), gross debt of governments globally has increased significantly since the crisis (end of 2007). General government gross debt as percent of GDP in G20 advances countries have elevated by 46% between 2007 and 2015 to 112.54% and is expected to peak to 114.60% in 2016. IMF, in its World Economic Outlook (April 2016), had expressed deep concern about debt rising to an unsustainable levels in some countries following stagnation in world economy.

| General government gross debt as Percent of GDP | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Country | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Australia | 9.96 | 9.68 | 11.74 | 16.76 | 20.50 | 24.24 | 27.86 | 30.72 | 34.26 | 38.08 | 40.15 | 41.38 | 41.58 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brazil | 65.84 | 63.80 | 61.91 | 65.04 | 63.03 | 61.23 | 63.54 | 62.22 | 65.22 | 69.90 | 74.48 | 75.78 | 76.53 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China | 32.23 | 34.64 | 31.59 | 36.01 | 35.60 | 37.05 | 39.42 | 41.14 | 43.20 | 45.98 | 48.27 | 50.04 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| France | 64.24 | 64.19 | 67.85 | 78.76 | 81.46 | 84.95 | 89.23 | 92.42 | 95.14 | 97.01 | 98.06 | 97.93 | 96.94 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Germany | 66.26 | 63.46 | 64.90 | 72.39 | 80.25 | 77.64 | 79.04 | 76.86 | 73.11 | 69.50 | 66.63 | 64.11 | 61.64 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| India | 77.11 | 74.03 | 74.54 | 72.53 | 67.46 | 68.10 | 67.45 | 65.81 | 66.07 | 65.26 | 63.89 | 62.80 | 61.72 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Japan | 186.00 | 183.01 | 191.81 | 210.25 | 215.95 | 229.84 | 236.76 | 242.59 | 246.42 | 246.14 | 246.96 | 248.58 | 249.55 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Russia | 10.50 | 8.61 | 7.98 | 10.63 | 11.35 | 11.64 | 12.66 | 14.03 | 17.82 | 20.40 | 21.04 | 21.94 | 22.78 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| United Kingdom | 42.53 | 43.63 | 51.78 | 65.81 | 76.39 | 81.83 | 85.82 | 87.31 | 89.54 | 91.15 | 91.65 | 90.75 | 88.95 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| United States | 63.64 | 64.01 | 72.83 | 86.04 | 94.76 | 99.11 | 102.39 | 103.42 | 104.77 | 105.06 | 104.91 | 104.25 | 103.62 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| *Estimates Start after 2015. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Monetary Fund, Fiscal Monitor Database, April 2016

According to Bank for International Settlement (BIS), while public debt has increased significantly in AEs, private debt has also increased in EMEs. The debt of non-financial companies in EMEs has grown so rapidly that in 2013 it overtook that of AEs, as a proportion of GDP. Since then, the corporate debt of EMEs as a proportion of GDP has pulled ahead of that in the AEs even further. Corporate leverage in EMEs has risen in general while simultaneously the general profitability of EME non-financial companies has fallen. Following tables provide the glimpse of such developments over the years.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Source: Bank for International Settlement

| Amount Outstanding of Debt Securities (in $ billion) | |||||||||

| India | China | US | |||||||

| Q4-2007 | Q4-2014 | Q3-2015 | Q4-2007 | Q4-2014 | Q3-2015 | Q4-2007 | Q4-2014 | Q3-2015 | |

| Domestic debt securities | 425.1 | 684.4 | NA (699.4 till Q2) | 1688.1 | 5772.2 | NA (6524.7 till Q2) | 28384.7 | 35797.3 | NA (36278.4 till Q2) |

| International debt securities by National Issuers (in USD) | |||||||||

| a) Banks | 14.0 | 35.6 | 35.4 | 5.0 | 79.3 | 90.8 | 497.8 | 395.1 | 432.5 |

| b) Other financial corporations | 0.0 | 2.6 | 2.6 | 5.8 | 32.8 | 46.0 | 1279.2 | 1319.0 | 1359.0 |

| c) Non-financial corporations | 21.2 | 36.3 | 39.3 | 14.0 | 191.8 | 229.8 | 291.3 | 396.5 | 453.3 |

Source: Bank for International Settlement

The GFC in AEs has been accompanied by changes in the financial set-up in EMEs. New sources of finance and investor bases have been opened up for them while the traditional sources like domestic banks have turned more cautious. At the same time proactive measures taken by regulators based on lessons learnt from the experience of AEs has led to increasing confidence in the local debt markets. Curtailment of banks’ easy money policies in countries like India following increased regulatory requirements on account of rising bad loans and corporate defaults has enhanced the importance of alternative sources of funds for corporates. The process is also supported by banks themselves as it helps them to save on capital requirements while at the same time enabling them to maintain relationships with their clients as well as opening up new lucrative sources of revenue in the form of fees earned on advising on and arranging the raising of capital in the markets. The rising reliance on non-bank sources of funds especially in EMEs is proving to be a double-edged sword with reducing reliance on the banking system on one hand and increased market volatility and contagion spillover on the other adding to the complexity in policy making. This write-up studies the changes in India in the light of these transformations taking place across EMEs.

Developments in EMEs

The accommodative monetary policies in major AEs coupled with record low rates has enhanced the interest towards EMs in the search for yields, thereby increasing the demand for debt securities issued there. There is evidence that domestic banks have faced increased competition from debt securities markets in financing some EME borrowers, particularly after 2008 (BIS November 2015). The share of bank credit in total credit has generally declined over the past decade. There has also been a structural shift in the balance sheets of EME banks as sources of their funding and recipients of their credit have changed. While the growth of loans has declined, investments in corporate papers have been rising.

The Indian Banking Scenario

Historically the Indian banking sector has been the major driving force supporting the country’s growth by channelizing domestic savings towards capacity creations and the size of the banking sector in terms of assets and earnings has grown in line with the entire economy. However, over the past decade, Indian financial system has undergone many changes; a higher volume of debt financing, opening up of more venues to borrow funds. Bank credit is gradually losing steam in meeting the funding requirements of the Indian corporate sector with the rising risk averseness of banks and expansion of capital markets. Corporates are no longer hesitant in approaching the market to raise funds either through equity or debt. It has been a beneficial relationship with a wider choice for financial planning for corporates on one side and more choice for diversification for investors including banks themselves on the other. Increasing ease in the primary issuance process for various instruments has benefitted both sides and so has increased awareness and risk appetite among investors. This type of structural shift is likely to have significant implications on the transmission of policy measures as well as financial stability in an increasingly open financial system.

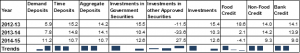

Select Aggregates of Scheduled Commercial Banks – Growth Rates (%)

Source: RBI and CCIL

As can be seen clearly, the growth in aggregate deposits with the Indian banking system has witnessed a sharp decline in 2014-15 which is also mirrored in the slowdown in bank credit. In fact, Non-Food Credit (NFC) grew at the slowest pace since 1993-94. Industrial sector which has over one fourth of share in total NFC witnessed gradual decline in the credit disbursal since 2014. Higher lending rates had an adverse effect of the credit directed to economic sectors like industries and services. Credit directed to industries fell continuously from 24% in FY10 to a single digit in FY15 and FY16 to 5.61% and 2.75% respectively. Service sector too have been witnessing declining y-o-y growth in the credit disbursal from banks, touching multi-year low of 3.19% till December 2015 (picking up in the last quarter of FY16 to take year-end growth to 9.06%). The accelerated growth in the “Personal Loans” has been the driving force in the historic low pace in the total bank credit to the positive territory especially housing and credit card outstanding. Banks’ reluctance to lower the lending rate because of the increasing stressed assets in the system and availability of cheaper sources of funds in the market is acting as a major deterrent to its growth. However, revival is anticipated as average base rate has fallen by 35 bps following constant reminders from the RBI Governor to banks for passing on the advantage of lower policy rates to the economic agents, further monetary policy easing during its First Bi-Monthly Monetary Policy by the RBI in April 2016 along with reducing interest rate on small saving schemes and switch to base rate calculation on the basis of the marginal cost of funds.

Banks in India still follow traditional business models and are less engaged in investment banking activities than are their AE counterparts. As a result, slowdown in NFC is mirrored by an increase in the share of investments in total bank assets, especially non-SLR holdings which majorly comprise of debt instruments issued by the private sector. Banking sector investments remained at record levels in FY16 resulting from continuous growth in banks’ non-SLR investments. Thus, Indian banks are indirectly supporting the corporate sector by subscribing to their debt instruments rather than extending direct credit to them.

Source: RBI

Debt Financing Options in India

Corporate Bonds

Bond markets help diversify the sources of financing and avoid credit risk concentration in the banking sector. A liquid corporate debt market can play a crucial role by supplementing the banking system to meet the requirements of the corporate sector for long-term capital investment and asset creation. Since bank credit has remained prime source of funding for corporates over the years indicates that banks are getting stretched to finance the growth of the economy.

In India, various recommendations announced by numerous committees (R. H. Patil committee 2005, Percy Mistry committee 2007, Raghuram Rajan Committee in 2009 etc) have resulted in a list of reforms to deepen and develop the corporate bond market as listed in the subsequent table.

| Impact of Measures Taken by the GoI, the RBI and the SEBI to Develop CB Market in India | ||

| Top of Form

Intended outcomes mostly achievedBottom of Form |

Intended outcomes partially achieved/ too early to say | Intended outcomes not achieved |

| 1) Setting up of reporting platform for post-trade transparency | 1) Banks and PDs allowed to become members of stock exchanges to trade in corporate bonds | 1) Introduction of Repo in corporate bonds to meet the funding needs |

| 2) Introduction of DvP in settlement of OTC trades to eliminate settlement risk | 2) Investment norms for banks and PDs relaxed to facilitate investment in corporate bonds | 2) Introduction of Credit Default Swaps to facilitate hedging of credit risk by the holders of corporate bonds, reissuance of bonds permitted by SEBI Bottom of Form |

| 3) Issue of long-term bonds by banks (exempted for NDTL computation) with a minimum maturity of 7 years to raise resources for lending to (a) long term projects in infrastructure sub-sectors, and (b) affordable housing. | 3) Final guidelines issued for partial credit enhancements by banks to corporate bonds | |

| 4) The investment limit for Foreign Portfolio Investors (FPI) has been increased to USD 51 billion during the last few years. Withholding tax rate has been reduced from 20% to 5%. They are allowed to invest only in CBs having residual maturity of at least 3 years. | 4) Measures taken to encourage investor interest/participation in the corporate bond market in terms of liberalizing the listing requirements; simplification in procedures and processes, simplified disclosure norms and standardisation of market conventions | |

| 5) International financial institutions like IFC were permitted to float a rupee linked bond overseas to deepen the off-shore rupee bond market, to raise rupees to invest in India. | 5) Rationalisation of FPI regulations has been put in place for easier registration process and operating framework for overseas entities seeking to invest in Indian capital markets | |

| 6) SEBI has allowed setting up of dedicated debt segment on the exchanges | ||

Source: RBI. Speech by Shri Harun R. Khan, Deputy Governor on Corporate Bond Markets in India: A Framework for Further Action – November 06, 2015.

The amount of corporate bonds issuance has increased by 76% between 2010-11 and 2014-15, while number of issues leaping by 82%. Net outstanding too amplified by 99% during the same period under consideration. If we extend the period by one more year, bond issuances between 2010-11 and 2015-16 rocketed 101%, issuance amount by 114% and net outstanding by 128%.

| Issues and Total outstanding Corporate Debt (Amount in Rs. Crore) | ||||||

| Year | Issuance details | % change in issuance | Net outstanding (As at end-March) | No. of outstanding instruments | % change in outstanding amount | |

| No. of issues | Amount | |||||

| 2012-13 | 3,023 | 380,411.62 | 27.48 | 1,261,717.15 | 8,859 | 23.79 |

| 2013-14 | 3,136 | 383,320.05 | 0.76 | 1,446,057.68 | 9,186 | 14.61 |

| 2014-15 | 4,257 | 466,247.13 | 21.63 | 1,702,756.47 | 10,810 | 17.75 |

| 2015-16 | 4,696 | 564,099.70 | 20.99 | 1,956,445.64 | 12,624 | 14.90 |

Source: Securities and Exchange Board of India, RBI.

In the corporate bond market, funds are raised through either public issues or via private placements. In the prior scenario, an offer is made to the public in general to subscribe to the bond. On the other hand, private placement is an issue of securities to a select group of persons (less than 50). While the private placement disclosure and documentation requirements are viewed by the market to be comprehensive, disclosure requirements for public issuance of debt are viewed by the market as being extremely arduous and difficult to comply with. Since the market for public debt does not exist, it does not make any economic sense to spend a good part in issuance.Hence, this market is dominated by the private placements. The limited disclosure, customized structures to cater the requirements of both issuer and investors and the fast speed of raising funds have made this route more attractive for the corporates to raise funds from the market.

| Modes of Debt Issues Used by Corporate Sector | |||||

| Year | Debt Issues (Rs. Crore) | Total | |||

| Public | Private Placement | ||||

| Amt | Share (%) | Amt | Share (%) | ||

| 2012-13 | 16982 | 4.49 | 361462 | 95.51 | 378444 |

| 2013-14 | 42383 | 13.31 | 276054 | 86.69 | 318437 |

| 2014-15 | 9713 | 2.35 | 404137 | 97.65 | 413850 |

| 2015-16 | 33812 | 6.87 | 458073 | 93.13 | 491885 |

Source: Securities and Exchange Board of India

Slowly and steadily this market is developing in terms of volumes and number of issuances. Over the last couple of financial years, banks rigidity towards lowering of its base rate in line with the easy monetary policy adopted by the RBI has helped corporate bond market to establish itself as an alternative to bank credit as one of the sources of funds for corporates. For example, while RBI slashed LAF Repo rate by 50 bps between December 2014 and March 2015, banks’ inability to replicate this change led corporates to tap the bond market as evident from higher number of issuances (2371 in 2014-15) and lower average fixed rate coupon (from 11.34% in 2012-13 to 11.09 in 2014-15%).

| Issuances of Fixed Rate Corporate Bonds | ||||

| Year | Number of Issuances | Avg Coupon of fixed rate CB Issuances | Avg Base Rate | LAF Repo at the end of fiscal |

| 2012-13 | 1142 | 11.34 | 10.13 | 7.50 |

| 2013-14 | 1717 | 11.34 | 10.05 | 8.00 |

| 2014-15 | 2371 | 11.09 | 10.13 | 7.50 |

| 2015-16 | 2549 | 11.13 | 9.68 | 6.75 |

Source: NSDL

Out of total corporate debt issuances, high rated bonds considered to be the safest bet has lion’s share. AAA and AA rated bonds has combined share of over 72% in total CB issuances over the years.

| Rating Analysis of the Issuances of Fixed Rate Corporate Bonds | |||||||||

| Year | AAA | AA | A1 | A | BBB | BB | B | C | NA |

| 2012-13 | 433 | 470 | 13 | 117 | 24 | 9 | 0 | 3 | 73 |

| 2013-14 | 481 | 846 | 9 | 125 | 41 | 26 | 7 | 3 | 179 |

| 2014-15 | 789 | 929 | 11 | 241 | 126 | 53 | 5 | 0 | 217 |

| 2015-16 | 907 | 963 | 47 | 204 | 103 | 50 | 8 | 0 | 267 |

Source: NSDL

Apart from bonds, corporates as well as banks themselves are also increasingly using shorter term instruments like CP/CD that are generally considered to be part of the money market as the maturity is within a year.

Commercial Paper (CPs)

Indian companies generally issue CPs for meeting short-term fund requirements without collateral mainly to purchase inventory or to manage working capital. CPs may also be issued to take advantage of falling interest rates and retiring expensive bank loans and other debt on the companies’ books. CPs can thus, help corporates to diversify their liability books. Since their introduction, primary and secondary market activity in CPs in India has had a chequered history reflecting the overall pace of economic activity and the prevailing interest rate regime or liquidity conditions. Over the years, the segment has gathered support from various regulatory measures especially the delinking with working capital requirements in 2000, changes in the issuer and investor base, reduction of stamp duty in 2004 and other taxes, changes in maturity profile, etc. However, the pace of activity in the CP market has grown rapidly in recent years following the implementation of the base rate system for banks which restrict them from lending at rates lower than their base rates. Banks can bypass these guidelines by investing in the CPs of their corporate clients at lower rates rather than extending them loans directly.

Source: RBI, CCIL

CP issuance has ballooned up in the last two years primarily as a reaction to the delay in banks’ passing on interest rate cuts. Highly rated corporates often found it cheaper to raise funds directly from the market through issuing CPs rather than borrowing from banks while CPs also gave corporates the advantage in terms of tenor of issue and flexibility of end-use. The spread between average interest rate of new CP issuances and the average base rate of banks has come down gradually falling from 101 bps in FY13 to 50 bps in FY14, further declining to 17 bps in FY15 before turning to (-) 8 bps in FY16 implying the market driven movement of CP rates as against the stickiness of base rates. The spread remained mostly in the negative territory in FY16 till mid-February 2016, rising significantly thereafter as the latest SEBI norms restricting mutual fund investments in debt instruments such as commercial paper and corporate bonds started weighing in on the yields along with the liquidity shortage during the fiscal year ending. This largely explains the substantial issuances over the past year. Apart from corporates even NBFCs and financial institutions also resorted to enhanced issuance of debt papers such as CPs instead of borrowing from banks at higher rates.

CPs are purchased primarily by institutional investors such as banks and mutual funds which generally invest money from their liquid/short term funds in CPs. Insurance companies also invest in CPs to diversify their portfolio. Retails investors can indirectly participate in this market by buying short term debt funds. Commercial banks have gradually started to increase their investments in CPs, with their holdings of CP exceeding their mutual fund holdings since September 2015. On an average they have held almost 23% of the total outstanding CPs during FY16 which was an increase over their average holding of 15% of the outstanding during FY15. Trading activity in the secondary market has also picked up with issuances as participants try to take advantage of falling interest rates.

Commercial Paper – Trading

Analysis

| Residual Maturity (Months) | 2012-13 | 2013-14 | 2014-15 | 2015-16 | ||||||||

| Share (%) | WAY (%) | Spread over G-sec (bps) | Share (%) | WAY (%) | Spread over G-sec (bps) | Share (%) | WAY (%) | Spread over G-sec (bps) | Share (%) | WAY (%) | Spread over G-sec (bps) | |

| 1 | 64.59 | 8.65 | 58.77 | 71.98 | 8.86 | 30.31 | 75.07 | 8.56 | 29.50 | 68.91 | 7.86 | 68.48 |

| 2 | 15.35 | 8.87 | 75.39 | 13.60 | 9.11 | 52.34 | 11.11 | 8.76 | 42.79 | 12.39 | 7.97 | 72.09 |

| 3 | 11.04 | 9.04 | 93.72 | 5.77 | 8.85 | 65.79 | 5.70 | 8.75 | 36.33 | 8.51 | 7.82 | 52.44 |

| 4 | 2.13 | 9.37 | 128.04 | 1.49 | 9.58 | 91.90 | 2.24 | 8.87 | 50.10 | 2.02 | 7.96 | 61.36 |

| 5 | 1.47 | 9.29 | 124.95 | 1.16 | 9.80 | 87.20 | 1.06 | 8.99 | 52.31 | 1.52 | 8.14 | 74.97 |

| 6 | 0.98 | 9.51 | 144.31 | 1.03 | 9.64 | 112.26 | 1.04 | 8.91 | 40.64 | 1.00 | 8.22 | 82.28 |

| 7 | 0.52 | 9.79 | 167.24 | 0.75 | 10.38 | 120.16 | 0.31 | 8.96 | 45.56 | 1.22 | 8.24 | 66.82 |

| 8 | 0.79 | 9.78 | 170.73 | 0.55 | 9.89 | 107.82 | 0.36 | 9.08 | 55.57 | 0.97 | 8.27 | 72.41 |

| 9 | 0.63 | 9.73 | 162.73 | 0.27 | 9.75 | 104.03 | 0.31 | 9.18 | 90.22 | 0.44 | 8.28 | 73.06 |

| 10 | 0.54 | 9.41 | 128.35 | 0.89 | 9.49 | 111.34 | 0.48 | 9.24 | 93.71 | 1.17 | 8.35 | 89.07 |

| 11 | 0.43 | 9.27 | 128.83 | 0.63 | 9.63 | 111.03 | 0.86 | 9.17 | 92.02 | 0.96 | 8.47 | 95.58 |

| 12 | 1.52 | 9.37 | 124.50 | 1.88 | 9.81 | 113.61 | 1.45 | 9.15 | 85.53 | 0.88 | 8.59 | 117.02 |

| Total (Face Value in Rs. Crore) | 513864 | 416598 | 544449 | 614951 | ||||||||

Excluding Inter Scheme Transfers. Source: CCIL

Secondary market trading is primarily concentrated in CPs rated as A1+, the highest credit quality rating assigned to short-term debt instruments. Wary of the increasing NPAs and the high provisions required to address them while at the same time in an attempt to keep highly rated corporate accounts in their books, banks are increasingly investing in their debt instruments such as CPs and bonds instead of directly lending to them even as corporates are opting to raise funds directly from the market rather than borrowing funds from banks at higher rates. This trend is stronger for public sector banks which have emerged as the largest net buyers of CPs in the secondary market. In terms of overall activity in the secondary market, the Mutual Funds followed by Corporates are the most active participants. Secondary market trading is mostly concentrated in the up to 3 months maturity papers.

NBFCs are important financial intermediaries in India playing a supplementary role to banks. NBFCs include not just the finance companies, but also a wider group of companies that are engaged in investment, insurance, chit fund, nidhi, merchant banking, stock broking, alternative investments etc. as their principal business. Traditionally bank loans were the source of funds for these firms. However, these firms are now increasingly raising funds through market-based instruments such CPs, debentures, or other structured credit instruments. NBFCs accounted for more than 55% of the total CP issues during FY16. Analysis of secondary market CP trading data indicates that CPs issued by NBFCs are the most traded in line with their share in issuances, with CPs issued by NBFCs accounting for 80% of the total traded volumes in FY16.

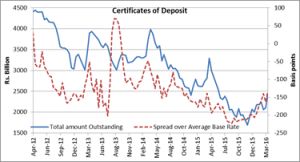

Certificate of Deposits (CDs)

CDs are an important source of raising funds for the banks themselves. CDs are used by banks to meet their temporary asset-liability mismatches. CD rates are higher than yields on government securities as investors are required to deposit funds for a specified term exposing them to credit risks as against the risk-free sovereign securities. CD rates are also higher than retail fixed deposit rates as they are raised when banks face liquidity crunch as well as to account for the stamp duties payable on their issuance. CD issuances fall amid easy liquidity. Institutional investors like mutual fund houses and banks are the key investors/buyers of these instruments.

Source: RBI, CCIL

CD issuances spike up during financial year ends as well as reissuances due to liquidity tightness. To address the spike in the CD rates at financial year-ends as banks rushed to meet targets, the Finance Ministry issued norms that required banks to reduce the proportion of bulk deposits and CDs to 15% of the total deposits by March 31, 2013. This led to a substantial decline in CD issuances with most public sector banks being near their issuance limits. Recognizing that bank investments in liquid schemes of mutual funds would, in turn, be invested in bank CDs, that could lead to systemic risks, RBI banned banks from holding more than 10% of their net worth in liquid schemes of mutual funds from January 2012. At the same time, Sebi’s decision to reduce the threshold for mark-to-market requirement on debt and money market securities of mutual funds from 91 days to 60 days also contributed to reductions in CD holdings. While the market lost some appetite due to the several restrictions imposed on the participants by regulators, the slow credit off take has also been a contributor to the contraction of the CD market. Secondary market trading in CDs has been in a declining trend in line with the decline in issuances.

Certificate of Deposit – Trading Analysis*

| Residual Maturity (Months) | 2012-13 | 2013-14 | 2014-15 | 2015-16 | ||||||||

| Share (%) | WAY (%) | Spread over G-sec (bps) | Share (%) | WAY (%) | Spread over G-sec (bps) | Share (%) | WAY (%) | Spread over G-sec (bps) | Share (%) | WAY (%) | Spread over G-sec (bps) | |

| 1 | 22.16 | 8.49 | 40.17 | 20.23 | 8.75 | 19.69 | 26.50 | 8.37 | 6.46 | 28.24 | 7.61 | 37.67 |

| 2 | 18.12 | 8.68 | 56.55 | 25.08 | 8.99 | 44.04 | 27.15 | 8.56 | 18.01 | 22.90 | 7.62 | 30.66 |

| 3 | 25.87 | 9.03 | 87.89 | 22.18 | 8.87 | 53.42 | 24.64 | 8.63 | 25.04 | 28.76 | 7.75 | 41.88 |

| 4 | 6.45 | 9.05 | 92.82 | 3.09 | 9.00 | 71.83 | 4.15 | 8.70 | 27.51 | 2.10 | 7.69 | 35.55 |

| 5 | 3.04 | 8.88 | 75.30 | 2.02 | 8.86 | 57.19 | 2.11 | 8.75 | 24.89 | 1.46 | 7.66 | 30.11 |

| 6 | 3.97 | 8.93 | 83.59 | 2.93 | 9.05 | 56.04 | 2.24 | 8.75 | 25.13 | 2.99 | 7.78 | 47.12 |

| 7 | 2.42 | 9.10 | 95.33 | 1.54 | 9.73 | 73.54 | 1.10 | 8.75 | 27.01 | 1.60 | 7.79 | 32.36 |

| 8 | 1.94 | 9.17 | 104.51 | 2.28 | 9.06 | 69.07 | 1.05 | 8.89 | 28.67 | 1.64 | 7.84 | 31.04 |

| 9 | 2.16 | 9.20 | 108.76 | 2.82 | 8.50 | 74.65 | 1.17 | 8.82 | 30.10 | 1.54 | 7.95 | 37.84 |

| 10 | 2.18 | 9.46 | 128.52 | 2.26 | 8.59 | 79.57 | 1.50 | 8.92 | 31.59 | 1.96 | 8.09 | 41.58 |

| 11 | 2.01 | 9.45 | 129.00 | 2.96 | 8.71 | 77.20 | 1.72 | 8.94 | 39.50 | 1.89 | 8.18 | 46.30 |

| 12 | 9.67 | 9.20 | 118.19 | 12.60 | 9.41 | 72.55 | 6.67 | 8.75 | 46.93 | 4.92 | 8.04 | 69.33 |

| Total (Face Value in Rs. Crore) | 1733410 | 1501309 | 1322377 | 1084800 | ||||||||

*Excluding Inter Scheme Transfers. Source: CCIL

On an average nearly 80% of the total secondary market trading in CDs has been concentrated in CDs maturing within 3 months, although issuances are mainly concentrated in CDs maturing in 12 months or more. Mutual Funds, Public Sector Banks and Private Sector Banks are the most dominant participants in the secondary market. The spread over g-secs in the secondary market trading of CDs had been narrowing sharply till the last fiscal. However, the spreads have started inching up again in recent months owing to rising liquidity tightness as well as increasing uncertainty in markets due to global developments along with competition from other money market instruments offering higher yields.

CDs can get a boost from with the development of a benchmark Certificate of Deposit (CD) curve for inter-bank lending and borrowing based on dealt rates of various tenors of maturity up to a year. This measure will bring more transparency and lead to better pricing as CDs are currently priced through negotiations with the rates decided according to the demand, supply and credit risks involved.

External Commercial Borrowings (ECBs) / Foreign Currency Convertible Bonds (FCCBs) / Trade Credit

Indian corporates are tapping foreign money via ECBs, FCCBs or trade credits, taking advantage of lower global interest rates and the ability to borrow at longer maturities. ECBs are commercial loans taking many forms like bank loans, buyers’ credit, suppliers’ credit, floating rate notes, fixed rate bonds, non-convertible/convertible preference shares availed of from non-resident lenders with a minimum average maturity of 3 years. There are two routes, through which ECB can be accessed, namely,

- Automatic Route – Do not require prior approval from the RBI or GoI. Eligible borrowers can raise funds for investment in infrastructure sector, specified service sector, industrial sector, acquisition of shares in the disinvestment process to the public under the Government’s disinvestment programme of PSU shares, import of services etc.

- Approval Route – Prior approval is needed from the RBI or GoI before availing the facility. Eligible borrowers can raise funds for investment in the real sector (industrial and infrastructure), for working capital for civil aviation sector, general corporate purposes from direct foreign equity holders. Low Cost Affordable Housing etc.

Note: eligibility for an ECB in respect of eligible borrowers, recognized lenders, end-uses, etc. to be read in conjunction and not in isolation (RBI).

FCCBs are bonds issued in foreign currency by an Indian company to be subscribed by non-residents. The principal and interest too is payable in foreign currency and its issuances are governed by the scheme “Issue of Foreign Currency Convertible Bonds and Ordinary Shares (Through Depositary Receipt Mechanism) Scheme, 1993” as amended from time to time. This convertible bond is a mix between a debt and equity instrument as in bond subscribers receives regular coupon and principal payments. However, clauses under FCCB allow the issuer or bondholder to convert the bonds into shares during its term, at a pre-agreed price. The investors receive the safety of guaranteed payments on the bond and are also able to take advantage of any large price appreciation in the company’s stock.

There are certain requirements that needs to be satisfied for the issuances of FCCBs. They are (as per notification FEMA No. 120/RB-2004 dated July 7, 2004);

- FCCBs shall have maturity of 5 years and above;

- the call & put option, if any, cannot be prior to 5 years;

- issuance of FCCBs only without any warrants attached; and

- the issue related expenses not exceeding 4% of issue size and in case of private placement, shall not exceed 2% of the issue size.

Since, issuance of FCCBs was brought under the ECB guidelines in August 2005 these are also subjected to all the regulations which are applicable to ECBs. RBI has also made provision for the refinance of FCCBs by Indian companies having difficulty in meeting the redemption obligations. Once terms and conditions set out by the RBI like the amount of fresh ECB/FCCB not to exceed the outstanding redemption value at maturity of the outstanding FCCBs; the fresh ECB/FCCB to be raised with less than six months prior to the maturity of the outstanding FCCB etc (Master Circular on External Commercial Borrowings and Trade Credits – July 01, 2013) are met, designated AD Category – I banks have been permitted to allow Indian companies to refinance the outstanding FCCBs under automatic route. Here, ECB/FCCB beyond USD 500 million for the purpose of redemption of the existing FCCB are considered under the approval route.

Trade credits refer to the credits extended by the overseas suppliers, banks and financial institutions for maturity up to five years for imports into India. Depending on the source of finance, such trade credits include suppliers’ credit or buyers’ credit. Suppliers’ credit relates to the credit for imports into India extended by the overseas supplier, while buyers’ credit refers to loans for payment of imports into India arranged by the importer from overseas bank or financial institution. These are a big source for funding for medium and small scale companies that have relatively less access to bank credit as this leads to the cost of working capital falling sharply. Over the past 2 years RBI has liberalized its policy providing greater flexibility for structuring of trade credit arrangements as well as conversion of trade receivables into liquid funds through setting up of an institutional mechanism for financing trade receivables. In November, RBI granted “in-principle” approval to three applicants to set up and operate Trade Receivables Discounting System (TReDS) under the Payment and Settlement System (PSS) Act 2007. TReDS will allow SMEs to post their receivables on the system and get them financed. This will not only give them greater access to finance but will also put greater discipline on corporates to pay their dues on time.

The following table provides the amount borrowed by corporates under ECB/FCCB from FY2012-13. Amount raised under FCCBs is very negligible – only 3 instances under automatic and approval routes amounting to USD 794 million each during the period under review and mainly for the purpose of redemption of FCCBs or refinancing of earlier ECB.

| External Commercial Borrowing (Amt. in $ Mn. Growth in %) | ||||||

| Year | Automatic Route | Approval Route | Total | |||

| Amount | Growth | Amount | Growth | Amount | Growth | |

| 2012-13 | 18395 | -28.76 | 13651 | 34.57 | 32046 | -10.90 |

| 2013-14 | 12347 | -32.88 | 20892 | 53.04 | 33239 | 3.72 |

| 2014-15 | 19215 | 55.63 | 9170 | -56.11 | 28385 | -14.60 |

| 2015-16 | 13411 | -30.20 | 10961 | 19.53 | 24372 | -14.14 |

Source: RBI

Macro-economic developments, global integration and the experience of administering the ECB regime over many years led RBI, in consultation with the GoI, to review and revise the extant of ECB framework from time to time. RBI reviews and revises all-in-cost ceiling which involves every cost in a financial transaction and can be used to explain the total fees and interest included in a financial transaction. The ceiling for ECB having average maturity of 3-5 years and above 5 years is 350 bps and 500 bps respectively over the 6-month LIBOR for the respective currency of credit or applicable benchmark (A.P. (DIR Series) Circular No. 99 dated March 30, 2012). Similarly, all-in-cost ceiling for trade credits with maximum maturity of 5 years is 350 bps over 6-month LIBOR. The amount of borrowing from trade credit/ECB/FCCB under both the routes along with the average all-in-cost ceiling for different average maturity are listed in subsequent table. Here, for simplification, average maturity is categorized into 5 buckets.

| Bucket-wise Summary of Total Amount Borrowed via ECB | ||||||

| Automatic Route | Approval Route | |||||

| No | Total Amount Borrowed ($ Mn) | Average All-in-Cost Ceiling | No | Total Amount Borrowed ($ Mn) | Average All-in-Cost Ceiling | |

| 2012-13 | ||||||

| Upto 3 Years | 25 | 181.30 | 4.0844 | 13 | 2275.57 | 4.0269 |

| 3 Years to 5 Years | 264 | 3751.93 | 4.1284 | 16 | 1500.90 | 4.0756 |

| 5 Years to 7 Years | 248 | 4546.74 | 5.6161 | 25 | 2466.28 | 5.5988 |

| 7 Years to 10 Years | 192 | 4965.81 | 5.6131 | 16 | 1487.35 | 5.5656 |

| Above 10 Years | 96 | 4949.04 | 5.6070 | 22 | 5921.07 | 5.5986 |

| 2013-14 | ||||||

| Upto 3 Years | 23 | 999.89 | 3.8835 | 22 | 6739.40 | 3.8686 |

| 3 Years to 5 Years | 181 | 2465.94 | 3.8850 | 21 | 4434.33 | 3.8686 |

| 5 Years to 7 Years | 174 | 3380.47 | 5.3805 | 33 | 3072.97 | 5.3712 |

| 7 Years to 10 Years | 122 | 1942.83 | 5.3781 | 42 | 2584.99 | 5.3705 |

| Above 10 Years | 73 | 3557.07 | 5.3740 | 23 | 4059.95 | 5.3713 |

| 2014-15 | ||||||

| Upto 3 Years | 37 | 3279.13 | 3.8435 | 11 | 761.93 | 3.8363 |

| 3 Years to 5 Years | 186 | 4093.33 | 3.8437 | 13 | 2018.31 | 3.8362 |

| 5 Years to 7 Years | 167 | 4942.28 | 5.3462 | 18 | 2493.27 | 5.3333 |

| 7 Years to 10 Years | 230 | 3456.07 | 5.3469 | 29 | 609.62 | 5.3324 |

| Above 10 Years | 116 | 3444.79 | 5.3403 | 17 | 3285.11 | 5.3324 |

| 2015-16 | ||||||

| Upto 3 Years | 47 | 2243.05 | 4.1577 | 3 | 1113.78 | 4.1600 |

| 3 Years to 5 Years | 173 | 2035.50 | 4.1058 | 13 | 5531.25 | 4.1562 |

| 5 Years to 7 Years | 144 | 2879.89 | 5.6773 | 9 | 547.37 | 5.6044 |

| 7 Years to 10 Years | 217 | 3325.19 | 5.5890 | 13 | 229.90 | 5.5700 |

| Above 10 Years | 91 | 2927.04 | 5.6724 | 9 | 3539.61 | 5.5156 |

Source: RBI

Funds raised by corporates from foreign entities are used for different purposes like import of capital and non-capital goods, for working capital, infrastructural development, modernization, general corporate purpose, refinancing of old debts, redemption of FCCBs etc. Since interest rates in US are far lower than that in India, it seems profitable for an Indian company to borrow money from US or other countries like EU or Japan.

Despite regular modifications and simplification in ECB policies and procedures w.r.t. re-schedulement of ECB (RBI press release May 09, 2014), refinancing of ECB at lower all-in-cost (August 27, 2014), parking of ECB proceeds with designated banks (November 21, 2014), rescheduling/restructuring of ECB (January 23, 2015), inclusion of different sectors to raise ECBs etc, the amount raised failed to pick up over the years. It has remained around USD 32,000 million from FY12 till FY14, falling thereafter to USD 28,385 million in FY15. Till the first half of 2015-16, such borrowing was just 41% of the total amount raised during the previous year, improving during the next two months to reach USD 20,000 million. While ECBs help companies take advantage of the lower interest rates in international markets, the cost of hedging the currency risk can be significant. If unhedged, exchange rate movements can prove adverse to the borrower. Apart from that, lower all-in-cost ceiling (the all-in cost involves every cost in a financial transaction and can be used to explain the total fees and interest included in a financial transaction such as a loan), restriction on end-uses did not make ECB as a favourable option to raise funds.

However, in a recent development, RBI has issued revised framework for ECB on November 30, 2015 by liberalizing end-use of ECBs, higher all-in-cost ceiling for long term foreign currency borrowings to make repayments more sustainable and minimizing roll-over risks for borrowers. It has also expanded the list of overseas lenders to include long term lenders like Sovereign Wealth Funds, Pension Funds as well as insurance companies, reduced the negative list of end-use requirements applicable to long-term ECBs and INR denominated ECBs and raised limits for small value ECBs with Minimum Average Maturity (MAM) of 3 years to USD 50 million from the existing USD 20 million along with few other changes. The revised ECB framework will work depending on the following three tracks:

- Track I : Medium term foreign currency denominated ECB with MAM of 3/5 years

- Track II : Long term foreign currency denominated ECB with MAM of 10 years

- Track III : Indian Rupee denominated ECB with MAM of 3/5 years

Revised ECB guidelines are expected to attract higher flow of funds from foreign entities to calibrate the policy towards capital account management in the changing dynamics of macro-economic conditions. While ECBs help companies take advantage of the lower interest rates in international markets, the cost of hedging the currency risk can be significant. This has given rise to the need for Masala bonds where the cost of borrowing can work out much lower.

Masala Bonds

Masala bonds are Indian rupee denominated bonds issued by Indian entities in offshore capital markets. In 2013, the International Finance Corp. (IFC), an investment arm of the World Bank launched the first ever “Rupee Linked Offshore Bond” programme. The programme created a rupee yield curve in the offshore market through issuances of various maturities i.e. 3, 5 and 7 years. These bonds provided globl investors a substitute for other EME local currency bonds, such as Indonesian Rupiah bonds. In terms of the investor profile, the largest amount was subscribed to by the US investors followed by the European and Asian investors. Subsequently, IFC was permitted to expand the issuance program and it issued a 10-year, Rs.10 billion bond (equivalent to US$163 million) in 2014. These bonds described as “Masala bonds” marked the first rupee bonds listed on the London Stock Exchange and are currently the longest-dated bonds in the offshore rupee markets, building on earlier offshore rupee issuances by IFC. IFC named these “masala bonds” as “masala” is a globally recognized term that evokes the culture and cuisine of India. These proceeds were meant for investment in an infrastructure bond issuance by a commercial bank in India. The IFC has also issued onshore rupee bonds in India to be used for lending to the infrastructure sector. These bonds are referred to as “Maharaja Bonds”.

RBI permitted Indian corporates to issue rupee denominated bonds overseas and issued details guidelines for the same on September 29, 2015. While RBI barred Indian banks from packaging and selling the bonds, any domestic corporate, infrastructure investment trust or real estate investment trust can now issue up to $750 million worth of masala bonds in any calendar year, with a minimum print maturity of five years. The guidelines allow a wide range of potential investors including retail investors as well as big institutions that currently lack a FII license to directly buy Indian securities a chance to tap straight into a relatively healthy and fast-growing market.

While the masala bonds are denominated in Indian rupees, they will be offered and settled in US dollars with international investors making it easier for foreign investors to participate in the issuances beyond the ceiling on their investments in corporate bonds issued onshore in India. The Indian issuers will not have to bear any currency risk as the borrowing and payment both are in rupees. The exchange rate risk thus is borne by the investors for whom the investment and settlement would happen in a foreign currency. Hence, unlike ECBs, in this case Indian companies can raise funds from foreign investors sans the currency risk. In a bid to promote the development of the market for these bonds the government clarified that a reduced 5 percent withholding tax will be applied on these bonds at par with that on ECBs and domestic corporate bonds. At the same time, Indian companies will be exempt from paying capital gains taxes for masala bonds sold by them abroad in case of rupee appreciation.

As of March 31, 2016, not a single masala bond had been issued by Indian companies. RBI has tried to address part of the problem by reducing tenure for these bonds to 3 years and bringing them under the overall limit for foreign investors in corporate bonds. The reduction in tenure is likely to reduce hedging cost for investors thereby reducing the cost of issuance for Indian firms.

Other Instruments

Indian companies are also actively borrowing directly from the general public primarily through corporate fixed deposits and non-convertible debentures (NCDs).

Corporate fixed deposits are basically the same as unsecured loans that do not guarantee anything to the investors in case of a default as these are not regulated by the RBI unlike bank deposits. These instruments are generally issued by NBFCs and corporate borrowers offering much higher interest rates than normal bank deposits and are best suited for investors with a risk appetite looking to diversify their portfolios and increasing their returns. Recent years have witnessed increased interest in these instruments as higher rated corporates can raise funds directly from investors through these deposits at relatively lower rates and at more ease than bank loans that are subject to several diligence checks by the bank. Investor interest has also increased in highly rated corporate deposits especially for the short-term tenors. Majority of these deposits are now being raised in the 12-60 Months basket. More than 80% of the offers for deposits rated AA or AAA although around 8% of the issues are unrated. There is an average spread of nearly 200 basis points between AAA and unrated deposits. Government housing companies typically offers the lowest rates while the highest are offered by lower rated corporates looking to raise funds for 1-3 years.

NCDs are like secured and redeemable bonds issued by corporates (including NBFCs) with original or initial maturity more than 90 days. Recent years have seen more and more corporates issuing NCDs and substituting bank loans. In fact of the 2988 new listings issued by Indian companies in 2015, 827 were NCDs and out of that 813 were issued on private placement basis. With increasing investor awareness, more and more NCDs are also being offered through public issues for retail investors. These NCDs are primarily issued by NBFCs as well as government companies linked to the infrastructure sector. Almost a third of all public issues of NCDs during the last three fiscal years were issued during the month of March. The highest number of public issues of NCDs was during 2013-14 after which the issuances declined significantly. In terms of amount raised, 2015-16 recorded the highest borrowing of funds through NCDs majorly for expansion, working capital requirements and general corporate purposes. Several companies approached the market multiple times for issuing NCDs. Funds were raised via the NCD route majorly by finance and few infrastructure companies, with many issues being oversubscribed at multiple times of the size of the base issue.

Public Issue – NCDs

| FY | Number of Issues | Final Issue Size (Rs. Crore) |

| 2012-13 | 20 | 16982.05 |

| 2013-14 | 35 | 42382.97 |

| 2014-15 | 25 | 9713.43 |

| 2015-16 | 20 | 52089.60 |

Source: SEBI

Traditionally, infrastructure lenders comprised of a long-term big borrower group for bank loans. However, several budget measures in recent years have opened up alternate sources of funding for these companies in the form of tax-saving and tax-free infrastructure bonds with which they can raise money from the general public. These infrastructure bonds have been accepted as a good investment option in the fixed income category as these are generally issued by government backed infrastructure companies and offer a decent rate of interest plus tax benefits. These developments have also had an adverse impact on expansion of bank credit.

Conclusion

BIS research indicates that financial booms in AEs go hand in hand with a misallocation of resources, depressing productivity on the way. Optimism and the illusion of sustainability makes even large debt levels appear sustainable to both borrowers and lenders when credit conditions are easy and asset prices soar. The levels of debt begin to look much more challenging as the cycle turns with the combination of falling asset prices, decline of profitability and more turbulent markets. The same trend is also currently reflected in the substantial stressed assets of the Indian banking system, especially of corporates in the power and mining sectors. The changes in the balance sheet structure of Indian banks from being mainly lenders of working capital, to being major providers of long term capital for large industrial and infrastructure projects, along with the declining household savings are bound to have significant liquidity implications once the economic cycle turns and demand for credit goes up. With increasing reliance of Indian companies on foreign borrowings, attracted through the super low global interest rates, the exchange rate has taken on an amplification role in generating stress not only in the foreign exchange markets, but also the overall financial system. These changing times call for changes in the formulation of market regulations as well as the system of operation of monetary policy.

******