Equity Restructuring: Analysing a new guideline

Ashok Banerjee Download ArticleThe principal objective of equity restructuring is to provide adequate returns to shareholders and improve investors’ confidence. Equity restructuring is also used as a strategic tool to minimise cost of capital, write-off losses and perhaps increase liquidity of stocks. Writing off losses or writing down assets against equity is a well-practiced strategy. What has assumed more significance recently is the use of free cash by a profit-making firm. Free cash is the cash left with a firm after meeting profitable investments requirements. It is the responsibility of the managers to ensure that such free cash is not unproductively used. A natural choice could be distribution of such free cash to the shareholders by way of dividend or share buyback. For example, the free cash flow per share of Apple has grown from USD 2.6 in 2010 to USD 12.6 in 2015. This is after significant share repurchase- the number of shares outstanding has dropped by 13% over the past five years for Apple. Apple has cash and marketable securities worth USD 233 billion out of total assets of around USD 300 billion in March 2016. Obviously there will be clamour for further distribution of free cash to the shareholders. In India, TCS reported a free cash flow per share of INR 95.7 in March 2016 up from INR 26.4 in 2010. This is after paying INR 26000 crore as dividend in the past two years. TCS got its shares listed in 2004 and has never repurchased its shares. TCS shareholders may soon demand even higher dividend payments. However, managers must ensure that they do not face underinvestment problem due to lack of cash in future. Therefore, an objective assessment of future capital expenditure is to be made before distributing free cash to the shareholders.

Prudent use of free cash is also a controversial issue for public sector enterprises in India. For example, Coal India had generated an operating cash flow of INR 197 billion in 2014-15 and spent only INR 49 billion in capital expenditure during the same period. Recently (May 2016) the Department of Investment and Public Asset Management (DIPAM), Ministry of Finance , Government of India has issued a guideline to all central public sector enterprises (CPSEs) on how to restructure equity and distribute free cash flows to shareholders. The guideline attempts to bring together all equity restructuring options under a consolidated document. The guideline also categorically highlights its binding nature and requires specific approval of DIPAM for any exemption. A CPSE is an entity where Government of India and/or Government-controlled one or more body corporate have controlling interest.

Table 1: Capital Restructuring Proposal for Central Public Sector Enterprises

| Mode | Condition/Criteria |

| Cash Dividend | Minimum annual dividend of 30% of PAT (Profit after tax) or 5% of Net Worth, whichever is higher |

| Bonus Shares (Stock Dividend) | Compulsory issue of bonus shares if reserves and surplus is equal to or more than 10 times of paid up capital |

| Share Buyback | Option to buyback should be exercised if Net Worth is at least Rs. 2000 crore and Cash and Bank balance at least Rs. 1000 crore. |

| Stock Splits | Compulsory split if market price or book value of a share exceeds 50 times of its face value. |

Source: Guidelines of Department of Investment and Public Asset Management (DIPAM), Govt. of India

Dividend Policy

The guideline of the Ministry of Finance did not require CPSEs to declare their dividend policy in the annual report. It simply mentioned the quantum of minimum dividend to be paid each year. The capital market regulator (SEBI) is contemplating mandatory disclosure of a company’s dividend policy in an initial public offering (IPO) prospectus. Regulators believe that shareholders demand transparency on dividend and have every right to know the expected use of cash, if the same is not distributed as dividend. SEBI has recently made it mandatory for top 500 listed companies to declare a dividend distribution policy to their shareholders. SEBI has also mentioned that if a company decides not to pay out dividend in a particular year, it must explain the reason and how the retained earnings will be used. A stated dividend policy will remove speculation and help analysts estimate fair value of shares. The Financial Reporting Council of UK has brought out a report[1] suggesting how companies can make dividend disclosures more relevant for investors.

The top ten[2] CPSEs have distributed Rs. 2.5 trillion as dividend over the past ten years (up to 31 March 2015) and spent only Rs. 1.3 trillion for organic growth (net capital expenditure). The dividend paid is more than 5% of net worth of the CPSEs. Though the gross capital expenditure of the top ten CPSEs was Rs. 3.4 trillion, much of it was funded by depreciation. Dividend paid by these CPSEs over the past ten years is almost equal to the GDP of Odisha as on March 2015. Therefore, even in the absence of such strong guidelines, the profitable CPSEs were paying handsome dividend to the shareholders, the principal beneficiary being Government of India. The top ten NIFTY companies (excluding CPSEs) paid Rs. 1.8 trillion as dividend during the same period- almost 30% lower than the CPSEs.

ONGC paid dividend of about Rs. 764 billion during the past ten years and spent Rs. 181 billion on capital projects. Coal India paid about Rs. 590 billion dividend in last ten years. The capital expenditure (net) incurred by the company during this period was abysmally low at only Rs. 2 billion. The third highest dividend paying CPSE was NTPC which distributed Rs. 418 billion as dividend and spent more than double of the amount (Rs. 863 billion) for capacity building. Government of India, as principal shareholder of the CPSEs, has directed all profitable CPSEs to follow the minimum dividend guideline. Is it right for the major shareholder to ‘compel’ companies to pay any pre-announced dividend? Any prudent dividend policy would lay down circumstances when dividend will or will not be paid. The quantum should only be decided after evaluating the following factors: (a) future expansion need; (b) profit earned; and (c) free cash flow. However, in view of huge cash pile up and lack of clear expansion plans, the CPSEs would definitely face the heat of the shareholders for distribution of free cash. The situation equally applies to companies in the private sector.

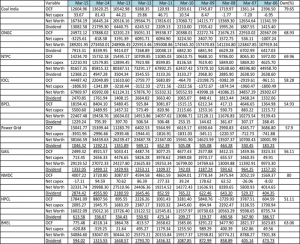

Table 2: Utilisation of Cash Flows of top 10 CPSEs (figs in Rs. Crore, unless otherwise stated)

Source: Ace Equity.

Net Capex=Capex- Depreciation. OCF= After-tax operating cash flows. Own(%)= Government ownership

Bonus Shares

The guideline directs that a CPSE should issue bonus shares if the retained earnings are more than 10 times paid up capital. The guideline further states that whenever the multiple (retained earnings/ paid up capital) exceeds 5, the concerned CPSE should evaluate the possibility of offering bonus shares. It is generally understood that bonus shares reward shareholders. Typically, whenever retained earnings of a company become disproportionately higher and the concerned firm is unable to reward its shareholder by way of cash dividend, bonus shares prove useful. However, it is also to be noted that issue bonus shares act as poison pill and create permanent pressure on the treasury of a firm for future dividends. In that sense, bonus debenture could be a better choice.

Seven out of top ten CPSEs are required to issue bonus shares if one follows the diktat of the DIPAM guidelines. Most of these are from energy sector. It may be noted that five of these CPSEs had already issued bonus shares in the last ten years. If Government of India has plans to disinvest further its stake in these CPSEs, it is always prudent to have lower equity base. The blanket guideline on issue of bonus shares would bloat the paid up capital of many entities thereby making them unattractive to potential investors.

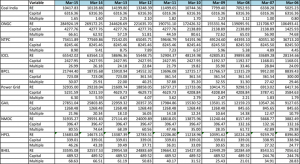

Table 3: Potential Bonus Issuance (figs in Rs. Crore, excepting the multiple)

Source: Ace Equity. RE= Retained earnings, Capital= Paid up capital, Multiple= RE/Capital

Share Buyback

Theory of corporate finance tells us that one of the motivations of share buyback is to distribute free cash to the shareholders so that the latter can use the funds profitably. There are examples of shareholders’ pressure for buyback whenever any company holds too much of cash. But the real question is how much cash is too much? The DIPAM guidelines provide that any CPSE with a cash balance of more than Rs. 1000 crore should seriously consider share buyback to distribute free cash. If one considers current investments as part of cash and cash equivalents, all the ten top CPSEs (Table 4) should buyback shares. The main motivation behind the guideline seems to be reducing the budget deficit of the central government rather than enhancing shareholder wealth. The guideline may also contradict its own recommendations. For example, ONGC is required to issue bonus shares, pay hefty dividend and also buyback shares- all in the same year! Whereas the financial statements of ONGC show that the company has already severely depleted its cash reserve from a high of 18% of total assets to only 1.2% in March 2015. It is always prudent to consider relative rather than absolute liquidity while taking a share buyback decision. One might of course argue that ONGC has spent only 7% of operating cash of past ten years in capital projects and hence clearly the company does not have any immediate need of hoarding cash. It has already paid 28% of its operating cash as dividend over the past ten years. Hence, there is no valid reason of ‘forcing’ the company to go for a share buyback with such a low relative liquidity position. The guideline should have specified a relative liquidity criterion (e.g., cash as a percentage of total assets) to trigger share buyback.

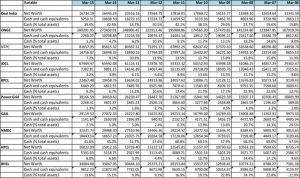

Table 4: Share Buyback Candidates (figs in Rs. Crore, unless otherwise stated)

Source: Ace Equity

Stock Split

There are two theories behind corporate motivation for stock split- first, split enhances liquidity of stocks and diversifies the shareholders; and second, it sends a signal of superior performance of the firm. Empirical evidence, however, supports the hypothesis of the liquidity theory. The DIPAM guidelines mention that whenever market price or book value of share of a CPSE exceeds 50 times its face value, the CPSE will split its shares appropriately. Figures for the financial year 2014-15 (not reported here) suggest that three out of top ten CPSEs (ONGC, NMDC and BHEL) is required to split their shares on book value basis. However, if one looks at the market value-to-face-value multiple, there are four companies (BPCL, NMDC, HPCL and BHEL) having such multiple more than 50 and hence are required to split stocks. If one CPSE has a face value of Rs. 10 per share, the guidelines suggest that the CPSE with a book or market value of share more than Rs. 500 should consider stock split. Isn’t that too predictable?

Equity restructuring is a continuous process and is used by the management as a technique to enhance the net worth of a company. Equity restructuring strategies increase the price-to-book multiple of firms. Share buyback is not that popular in India as the shares so bought back are to be cancelled. Cash dividend, on the other hand, is a more popular form of distribution of cash to shareholders. But dividend is stickier than share buyback. Hence, if a firm has to distribute a large amount of cash to shareholders, it is always prudent to opt for the buyback route. Any restructuring action generally conveys positive signal to the market. But if the actions are pre-defined and follow some cardinal principles, there would be no surprises and market would factor in such actions in the prices much before the actual events. Splitting stock when the market price exceeds INR 500 (with a face value INR 10) is too low a level for such action. For example, 43 out of 50 NIFTY companies have share prices more than 50 times of their respective face values. If these companies start splitting stocks (some of them have already done that), the market will witness a surge in supply which may not always increase the return of the stocks.

********

[1] https://www.frc.org.uk/Our-Work/Publications/Financial-Reporting-Lab/Lab-Project-Report-Disclosure-of-dividends-%E2%80%93-poli.pdf (accessed on 15 July, 2016)

[2] By market capitalization as on 30 June 2016