Sniff Test on the New IIP Series

Deep N Mukherjee Download ArticleThe new Series of Index of Industrial Production (IIP) which was launched with the Base Year 2011-12 provided a much needed refresh to 2004-05 Series. As such, these are periodic updates which are made so that macroeconomic indices, in this case, IIP represent the goods which reflect the changes in the economy while removing goods which are no longer relevant to the economy. However the new Series is not just about swap-in of relevant goods and swap out of economically irrelevant goods.

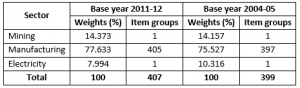

In terms of overall construct the weight of Manufacturing Sector has gone up in the updated IIP in comparison to the old Series, while the sector weight of Electricity has come down by a comparable amount. The higher weight on manufacturing is more representative of the higher importance of private sector manufacturing in the Indian economy in comparison to sectors which are heavily regulated by the government.

The Manufacturing Sector in the New Series has 809 items as compared to 620 in the old Series. As per Ministry of Statistics and Program Implementation (MOSPI), 149 new item are added in the new Series and 120 items from the old series has been removed.

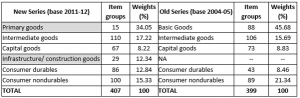

Further to improve the granularity of sectoral focus within industry, the New Series splits up Basic Goods into Primary Goods and Infrastructure/Construction Goods. This is a good move as it will give economy watchers an idea of economic activity associated with sustaining the economy. On the other hand, tracking Capital Goods and Infrastructure/Construction Goods IIP is expected to provide a better view of Capex activity.

Changes in Methodology: Certain changes made in IIP estimation methodology makes the output of the new series difficult to compare with that of the old series. In fact prima facie, one may have to wait for more values to come out of the new series in future to conclude whether these changes in the New Series improved the accuracy of tracking economy or they replaced one set of estimation errors and data issues with another set. Of course it must be borne in mind that no macro-economic measures or indices can be error free. An improvement in methodology for estimating these measures mean lesser estimation errors than in the past. The three changes which need to be understood to appreciate the output from the new Series are explained below.

Capital Goods Related Adjustment: Capital Goods form ~8% weight of IIP (both series). Capital Goods IIP, in the past, usually caused furore among market watchers whenever it was released. The market watchers criticised the lumpiness of the Capital Goods IIP number, often neglecting the fact that this was the nature of the animal. Units of most capital goods takes more than a month to produce so there are months when the goods are not finished so the IIP is low and in months when the production is complete the Capital Goods IIP number shoots up. This is a problem, possibly, with no perfect solution. However, responding to popular (which need not always be correct) criticism in the NEW Series, the approach adopted is one of calculating a measure called Operating Work-in-Progress (WIP) of Capital Goods. In fact companies use this type of accounting treatment to capture the value of unfinished capex or capital goods manufacture in their annual balance sheet. Companies calculate WIP typically once a year but at a company level. Larger well established companies may track WIP quarterly but mostly for internal purposes. It is difficult to conceive how mid-sized to small companies will calculate this on a monthly basis that too at a factory level to furnish the data for IIP estimation. So possibly the ‘volatility’ in capital goods IIP will be reduced but the jury is still out on whether there will be a qualitative improvement in the information content of the capital goods IIP.

Monetary Value of Production: IIP is expected to measure physical volume of output in an economy. However for certain products the volume is difficult to measure, in such cases the monetary value is considered and further processed to estimate the ‘real value’ which is taken as a proxy for volume. The monetary value is deflated by the relevant inflation measure to estimate ‘real’ production. Despite such adjustments, empirically it is observed that a rising inflation tends to benefit IIPs to the extent it has high component of ‘monetary value’ measure. In the new series production value for 109 items will be measured by monetary value (deflated by WPI). This number was 53 in the previous series.

Factory Frame: The new Series has a higher number of factories mostly to account for the additional new items. The Working Group for Development of Methodology for Compilation of All-India Index of Industrial Production with Base Year 2009-10/2011-12 suggested that apart from the factories covered under Annual Survey of Industries (ASI), factories covered by other sources may also be added to the New Series. As such measures, such as IIP, globally replaces closed factories with functioning factory but during the transition period the loss in production gets reflected in the IIP number. However when a new series is launched because of inclusion of stronger companies which remains open for most years around base year the production trend may be more positive for these selected factories than for rest of the economy where factories close down regularly. This may be among the reasons of why the new IIP growth is consistently above the previous series.

Some Expected Difference, Some Explained Difference: While the MOSPI clearly states that the two Series are not strictly comparable, a comparison between the two series may still be done to find out how our understanding of the economic performance for the last five years needs to be re-calibrated.

The new series shows higher growth than the old series in three-fourth of the months since April 2012 till date. The new series includes items which are actively produced as opposed to previous series where some items were hardly produced in any scale and this phenomenon may partly explain the higher growth numbers. However what becomes difficult to explain is why the growth trends are significantly diverging in the two series particularly from December 2015 till March 2017.

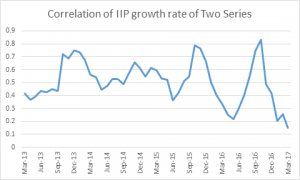

The author estimates approximately two-third of the weightage in the New Series is attributable to items which were common to the old series. Thus one may assume that there would be a high positive correlation between the two series- which has actually been the case till Dec 2015..

However, post 2015 that there is a sharp fall in correlation between the two Series as shown by the divergent trends. Given the disclosed information there is no clear explanation of this observation.

The Sniff Test of the New IIP Series:

The New Series adds factories from Department of Industrial Policy and Promotion ( DIPP) over and above factories identified under ASI. As such for our Sniff test we have taken the ASI survey (the latest one) and compared it with the annual average IIP( New Series) for the three years for which ASI data is currently available. As per the New Series the IIP growth has improved sequentially between 2012-13 and 2014-15

| Median IIP Growth -Annual (%) | |||

| 2012-13 | 2013-14 | 2014-15 | |

| 2011-12 | 1.9 | 3.4 | 4.1 |

| 2004-05 | 0.25 | -0.9 | 3.2 |

As per ASI, during those same years growth for most parameters has either fallen sequentially or has shown some improvement in 2013-14 and nose- dived in 2014-15.

| Growth Rate of Select Parameters From Annual Survey of Industries | |||

| 2012-13 | 2013-14 | 2014-15 | |

| NUMBER OF FACTORIES | 2% | 1% | 3% |

| TOTAL PERSON ENGAGED | -4% | 5% | 3% |

| FUELS CONSUMED | 10% | 12% | 0% |

| MATERIAL CONSUMED | 5% | 8% | 3% |

| VALUE OF OUTPUT | 6% | 9% | 5% |

| STOCK OF SEMI FINISHED GOODS | -31% | 17% | -45% |

| STOCK OF FINISHED GOODS | 10% | -56% | -9% |

Of course it is possible that the factories identified in DIPP have performed exceptionally well and thus when aggregated with factories identified by ASI, the overall output shows an improvement. Clearly more disclosures are required from MOSPI to help everyone understand the trend shown by the new IIP Series.