Twin Balance Sheet Problem, Indian Banking Sector, and the Budget of 2017-18: Have we forgotten Mary Poppins?

Partha Ray Download ArticleOf late, Indian banking sector has not been too well. Credit, deposits and assets are down significantly and there has been substantial increase in non-performing assets. In this context, the recently released Economic Survey, 2016-17 has noted the simultaneous deterioration of corporates’ as well as banks’ balance sheets and suggested some important measures. Has the Budget proposals of 2017-18 looked into the plight of banking sector sufficiently?

Problems in banks

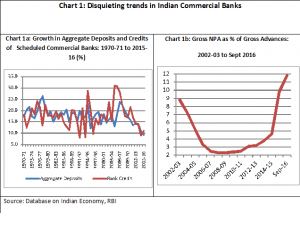

The recently released Report on Report on Trend and Progress of Banking in India 2015-16 of the RBI flagged out alarmingly that the consolidated balance sheets of the banking sector grew at meagre pace of 7.7 per cent during 2015-16. More importantly, the pace of expansion of deposits and credit of the scheduled commercial banks has registered unprecedented deceleration in 2015-16 (Chart 1a). Along with these decelerations, the other disturbing trend has been a significant deterioration of asset quality of public sector banks with their gross non-performing advances going up substantially to 11.8 per cent (of total advances); this pushed up the stressed advances (i.e., gross NPA plus restructured standard advances) to 15.8 per cent of total advances in September 2016 (Chart 1b). It looks like whatever has been achieved in terms of cleaning up banking sector balance sheet since the initiation of financial sector reforms all seemed to have wiped away now.

| Chart 1: Disquieting trends in Indian Commercial Banks | |

| Chart 1a: Growth in Aggregate Deposits and Credits of Scheduled Commercial Banks: 1970-71 to 2015-16 (%) | Chart 1b: Gross NPA as % of Gross Advances:

2002-03 to Sept 2016 |

| Source: Database on Indian Economy, RBI | |

This has affected the behaviour and performance of banks in India. The latest Economic Survey, 2016-17 put the impact somewhat dramatically, and went on to say:

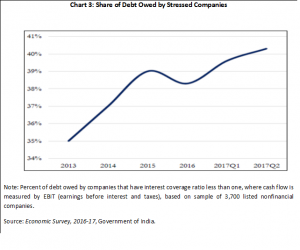

“In February 2016, financial markets in India were rocked by bad news from the banking system. One by one, public sector banks revealed their financial results for the December quarter. And the numbers were stunning. Banks reported that nonperforming assets had soared, to such an extent that provisioning had overwhelmed operating earnings. As a result, net income had plunged deeply into the red. …The news set off alarm bells amongst investors, who responded by fleeing public sector bank shares, bringing their prices to such low levels that at one point the medium-sized private sector bank HDFC was valued as much as 24 public sector banks put together” (Chart 2).

| Chart 2: Market Capitalisation – Public Sector Banks & HDFC (Rs. trillion) |

|

| Source: Economic Survey, 2016-17, Government of India. |

Why did it happen?

Number of reasons may be cited in this connection. Following are important in particular: (a) relaxation credit norms by the RBI in order to encourage bank lending after the global financial crisis; (b) the sharp fall in commodity prices since 2009 leading to sharp declines in the profitability of sectors such as steel and causing the problem of unpaid debt to banks from these and associated sectors; (c) the government thrust on infrastructure investment through public-private-partnerships (PPP) leading to huge new debt being contracted by highly leveraged Indian corporate entities investing in infrastructure; and (d) instances of governance issues with the management of select public sector banks and cases of political interference (Mohan and Ray, 2017).[1]

Twin Balance Sheet Problem

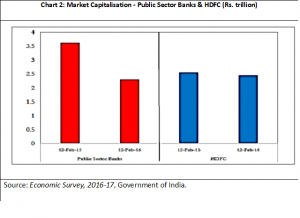

Economic Survey, 2016-17 in this context flagged the issue of “the Festering Twin Balance Sheet Problem”, whereby along with the deterioration of banking sector balance sheet, “around 40 percent of the corporate debt it monitored was owed by companies which had an interest coverage ratio less than 1, meaning they did not earn enough to pay the interest obligations on their loans” (Chart 3).

But what is to be done so as to have a resolution of this twin balance sheet problem? The Economic Survey, 2016-17 candidly argued in favour of establishing a formal agency that can resolve the large bad debt cases – something in the nature of a ‘Public Sector Asset Rehabilitation Agency’. This has been employed by the East Asian countries after they were hit by similar balance sheet problem in the 1990s. This is in the nature of a grand Bad Bank.

Budget, 2017-18 and the Banking Sector

Naturally, the analysis of Economic Survey created some hype about the shape of things to come the Budget of 2017-18 insofar as the banking sector is concerned. It is interesting to take look at the Budget proposals of 2017-18 in this context. The following deserve special mention.

First, the Finance Minister announced that a bill relating to resolution of financial firms would be introduced in the current Budget Session of Parliament. It was specifically noted, “This will contribute to stability and resilience of our financial system (and) will also protect the consumers of various financial institutions” (p. 20; Finance Minster’s Budget Speech, 2017-2018). It was expected that together with the Insolvency and Bankruptcy Code such as a resolution mechanism for financial firms will ensure comprehensiveness of the resolution system in India.

Second, in order to “streamline institutional arrangements for resolution of disputes in infrastructure related construction contracts, PPP and public utility contracts”, it was announced that, “the required mechanism would be instituted as part of the Arbitration and Conciliation Act 1996”.

Third, in order to solve “the stressed legacy accounts of Banks”, In line with the ‘Indradhanush’ roadmap, the Finance Minister has provided Rs. 10,000 crore for recapitalisation of Banks in 2017-18, and assured that, “additional allocation will be provided, as may be required”.

Fourth, listing and trading of Security Receipts issued by a securitization company or a reconstruction company under the SARFAESI Act has been permitted in SEBI registered stock exchanges. This is expected to “enhance capital flows into the securitization industry and will particularly be helpful to deal with bank NPAs”.

Finally, the Budget proposed to double the lending target of 2015-16 to Rs. 2.44 lakh crores under the Pradhan Mantri Mudra Yojana and added that, “priority will be given to Dalits, Tribals, Backward Classes, Minorities and Women”.

Have we forgotten Mary Poppins?

Are these measures sufficient to address the plight of the Indian banking sector? At one level, clearly these seem to be insufficient to recapitalize banks and kick-start the credit cycles; at another, one may note that devil may lie in the details that may emerge in the days to come. Thus, a definitive stance about the shape of things to come in the banking sector may be pre-mature.

In situations like this, one is reminded of the 1964 Walt Disney classic Mary Poppins, where Mr Banks takes his daughter Jane and son Michael to his work place, the Dawes Tomes Mousley Grubbs Fidelity Fiduciary Bank and the bank’s elderly chairman aggressively tries to persuade Michael to invest his modest savings (all of two pence or tuppence) in the bank and went on sing:

“If you invest your tuppence / Wisely in the bank / Safe and sound / Soon that tuppence / Safely invested in the bank / Will compound ……

You see, Michael, you’ll be part of / Railways through Africa / Dams across the Nile / Fleets of ocean greyhounds / Majestic, self-amortizing canals / Plantations of ripening tea

All from tuppence, prudently / Fruitfully, frugally invested / In the, to be specific, / In the Dawes, Tomes / Mousely, Grubbs/ Fidelity Fiduciary Bank!

In times like this, it may be good to remember Mary Poppins and the tuppence song!

******

[1] Mohan, Rakesh and Partha Ray (2017): “Indian Financial Sector: Structure, Trends and Turns”, IMF Working Paper, No. WP/17/7, available at https://www.imf.org/en/Publications/WP/Issues/2017/01/20/Indian-Financial-Sector-Structure-Trends-and-Turns-44554